Strides Arcolab to acquire Shasun Pharma in all stock deal

Combined entity will have revenues of Rs 2,500 crore spanning generics and API

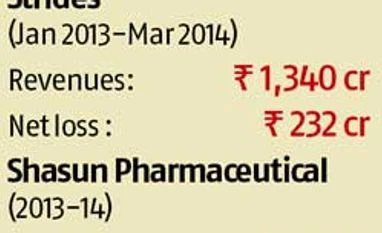

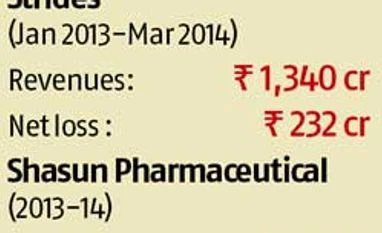

BS Reporter Bangalore Strides Arcolab, a Bangalore-based mid-size publicly-held pharmaceutical company, will acquire Chennai-based Shasun Phamaceutical in an all-stock transaction. The combined entity will have revenues of Rs 2,500 crore.

As part of this acquisition, shareholders of Shasun will get five equity shares of Strides in lieu of 16 Shasun shares. Based on the exchange ratio, Shasun shareholders will own 26 per cent of the combined entity. After the approval of the merger, the current promoters of Shasun will be categorised as promoters of the combined entity, along with the existing promoters of Strides.

This combination will create a vertically-integrated pharma company with presence in front-ended regulated markets finished dosages, emerging markets branded generics, institutional business, active pharmaceutical ingredients (API) and contract research and manufacturing services (Crams). A key rationale for this acquisition is to leverage on Shasun's footprint in the API manufacturing capacities.

According to a joint statement, this combination enhances finished dosages portfolio in niche and complex domains with a pipeline of 100 products and accelerates product filings with a combined research and development strength of 400 personnel. “It will also result in de-risking of operations with the combined entity having 12 manufacturing facilities including three USFDA (US Food and Drug Administration)-approved finished dosage manufacturing facilities, two USFDA-approved API manufacturing facilities, one USFDA-approved Crams facility and six manufacturing facilities catering to the emerging markets,” the statement added.

Commenting on the merger, Arun Kumar, founder and group chief executive officer of Strides, said: “Since the divestment of our injectables business, which resulted in significant value creation for our shareholders, Strides has re-focused on its oral finished formulation business. Today’s proposed combination with Shasun accelerates that step with use of our combined infrastructure.”

While Strides Arcolab stock gained a good 9 per cent to close at Rs 699.65 per share on NSE, Shasun stocked dropped by 0.33% and closed at Rs 196.15 per share on Monday.

)

)