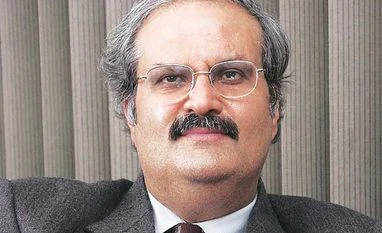

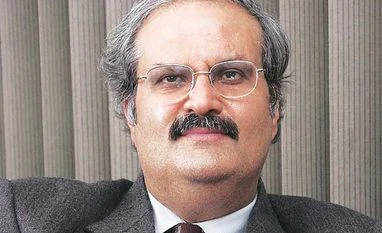

The idea is to build brands not just by advertising, but by advocacy, too: Sunil Duggal

Interview with CEO, Dabur India

Viveat Susan Pinto Fast moving consumer goods (FMCG) major Dabur is in the midst of change. Consumer health care is something the firm is increasingly betting on as the personal care market faces intense competition.

In an interview with Viveat Susan Pinto, Dabur's Chief Executive Officer (CEO),

Sunil Duggal, spells out the investments his firm is making in this regard. Edited excerpts:

You were among the first few FMCG CEOs to speak of an urban recovery well before it caught on. What makes you feel that it is due? My assessment was based on growth numbers. Rural is ahead of urban. But the gap is coming down, which to my mind indicates one of the two: That there is either a slowdown in rural or urban is gaining in terms of pace of growth. Right now, it is rural that is showing signs of a slowdown. Urban hasn't picked up yet, but indications are it will gain steam with sentiment picking up, a possible rate cut and improved liquidity. This should happen in the second half of the year.

For a company that made significant investments in the rural market in the past few years, is it easy switching your attention to urban? Consumers in the urban and rural areas are vastly different.

Yes, they are different. But let me indicate that even when we invested in rural areas in the past, we never took our eyes off urban. At this stage, it makes perfect sense for us to devote our attention to urban areas a bit more. Growth should come from there in the future. Will this mean rural will go off our map? Certainly not. But yes, there would be a recalibration of priorities, in keeping with future growth prospects. Which is why we have taken a few bets, such as our recent entry into baby care or the launch of value-added products such as Ratnaprash, a chawanprash targeted at adults, or a chocolate variant of Dabur Chawanprash, targeted at children, or an almond shampoo, an industry-first, or a hair oil under the Dabur Anmol franchise. All of this is in keeping with our thought process of a possible urban recovery in the future.

Personal care has become increasingly competitive and the action there has only grown with players such as Hindustan Unilever and Procter & Gamble cutting prices in shampoos. Is that what drove you to look at categories, including health care, which are relatively stable?

We derive 45-50 per cent of our India revenues from personal care. So, it still is the biggest category for us. Health care gives us 35-40 per cent of our revenues. But we see huge potential in health care, thanks to consumers' increased focus on health and wellness. Companies such as ours are in a position to take advantage of this shift. There is a huge catchment for our products in health care, which can be nurtured.

What are you precisely doing to nurture consumer health care?

We are focusing on building advocacy infrastructure. By advocacy infrastructure I mean building doctor advocacy. We have a large team in place that goes to doctors and details our health care products. These products are either in the market or are in the process of being launched. This is part of our integrated health care strategy, where the idea is to build brands not by promotion and media alone, but advocacy by doctors and even consumers.

Distribution plays a key role here. How are you building that up?

Distribution goes in tandem with our doctor advocacy programme. We had to give special attention to chemists, which we did in the past year or so. That project is largely over and gave us access to some 75,000 top chemists across cities. About 150,000-odd chemists were targeted by our regular sales and distribution team. So, our total direct reach in the chemist channel alone is about 225,000 now.

The long-term and more difficult enterprise, however, is doctor advocacy. The idea is to ensure doctors recommend and support our products, not just ones that are advertised, but those that are not. This is an initiative that takes time since doctors are interested in knowing how efficacious products are and what are the results of clinical trials conducted on these products. This is a long-term initiative.

How many doctors are you targeting with this programme?

The initial plan is to reach 25,000 practitioners. These will include general physicians, gynecologists and pediatricians. Specialists in other areas will come in at a later stage. It is a bit of an exploratory voyage at this stage. We have never done this before. There are no immediate pay-offs, but in the long-term, we should gain.

)

)