Korean auto major Kia, founded in 1944, three years before India became independent, is the latest entrant into the buzzing Indian car market, the fifth largest in the world. The crowded Indian car market has almost two dozen brands, including the luxury ones. This number continues to expand as growth-hungry global players bet big on India, projected to become the world’s third-biggest market with an annual size of five million cars by 2020.

Kia has decided to pump in Rs 7,000 crore to set up a manufacturing unit in Andhra Pradesh with an annual capacity of 300,000 units. Kia is not a total stranger to India: its parent, Hyundai, is the country’s second biggest car maker with a 17 per cent market share.

The company did not opt to set up manufacturing in Tamil Nadu where Hyundai’s manufacturing plants are located. The state is also home to other leading brands like Ford, Renault Nissan and BMW. Kia Motors President & CFO Han-Woo Park says there is potential for Kia to benefit from the existing infrastructure and logistics established by Hyundai’s Chennai plant, located 390 km away from the Kia site in Andhra Pradesh. “This proximity between the two facilities will benefit both of us, in terms of logistics and economies of scale.”

Kia plans to produce a compact sedan and compact SUV especially for the Indian market at the 563-acre plant in the second half of 2019. Globally, it has a line-up of compact cars including hatchbacks, sedans, and mid-range SUVs.

Kia has decided to completely skip the entry segment which brings significant volumes to companies like Maruti Suzuki, the market leader, and Hyundai. Instead, it wants to focus on the compact space of sedan and SUVs. Park adds the company is carrying out a feasibility study into a number of vehicles for production.

Hyundai India Managing Director YK Koo says Kia and Hyundai are different companies. “Management, operations and network... Everything will be different. Vendors can be shared for cost reduction, but strategy will be different. Their DNA is different. They have different sales and marketing strategies”. Koo goes to the extent of saying that Hyundai will be aggressive against Kia. “They are competition”.

Koo says it will not be easy for Kia to make inroads in India since the market has changed dramatically. “The auto industry has changed a lot; the competition is very different. Almost 19 players... To set up a factory is okay since people have money, but to survive and continue the success is a different issue,” he says. It is understandable that profitability could also be a challenge in the initial few years when the company will be on investment mode and localisation may be low.

It will be interesting to see how the two brands co-exist. They enjoy some synergies in the backend, while they compete in the market. We have successful examples globally such as the Renault-Nissan alliance. Then, there is Volkswagen and Skoda. Interestingly, both these entities also operate in the Indian market. Former Skoda CMD Sudhir Rao says the company enjoys a common parts distribution network with Volkswagen, a common training academy for service, common warranty administration, etc. Skoda cars get manufactured in Volkswagen’s Pune plant.

Rao, who had earlier also worked with Renault India, says from a broader perspective, each company in the group is different and so is the way they operate individual brands. “Here a sense of independence in operations is stronger as you are used to being separate companies globally. Therefore, you can clearly state your brand promise. It helps a lot,” said Rao.

While Kia will compete with its parent, rivals are not going to roll out the red carpet either. Maruti Suzuki says it is not worried about the rising number of competitors. “There was competition 10 years ago as well. We need to remain competitive. You have to adjust your strategies with the changing market. In spite of all the competition we are able to judge what the market wants and grow our share”, says Maruti Suzuki Chairman RC Bhargava.

Relying on vibrant design

Kia is a strong global brand and with the rising number of Indians travelling overseas there is an awareness of the brand. According to Kia, the company has witnessed significant growth in its brand equity in recent years — the result of design-led product development and efforts to cultivate a more emotional attachment to Kia and its cars.

According to Interbrand’s 2016 ‘100 Best Global Brands’ study, Kia is now the 69th most valuable brand in the world, and is recognised by consumers all around the globe for its vibrant, distinctive and reliable range of cars. The same study values the Kia brand at $6.3 billion.

The company says design forms a key part of its long-term plan to become one of the world’s leading automotive brands. The last decade has seen a design revolution at Kia, a shift which has fundamentally altered the way in which consumers around the world perceive Kia and its cars. Hyundai and Kia together are the world’s fifth largest car seller, with a volume just short of eight million units last year.

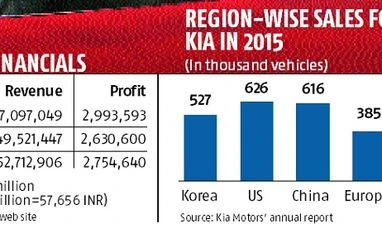

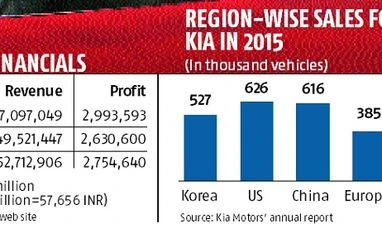

Kia, Korea’s oldest manufacturer of motor vehicles started its journey as a bicycle and motorcycle maker. It now rolls out more than three million vehicles a year from 14 manufacturing and assembly operations in five countries. These are sold in about 180 countries and bring revenue of $45 billion. More than half of Kia’s sales come from Asian markets, while America and Europe fetch about 27 and 18 per cent, respectively. China happens to be its biggest market.

)

)