Four years ago, India’s inflation was running at over 11 per cent. Now it’s melted to a record low of 2.2 per cent, below Mexico, Turkey and the UK, as the Reserve Bank of India’s (RBI’s) battle against price pressures gains traction.

The slide has prompted the RBI, led by Urjit Patel, to slash its inflation forecasts and led one member of its six-person monetary policy committee to break ranks at its June 7 announcement, stoking market speculation the bank could next cut rates, perhaps as early as August.

So what has changed? Economists say cyclical or temporary issues like a stronger currency and weaker domestic demand, combined with structural factors such as better food management by Prime Minister Narendra Modi’s government are in play.

There are risks the cyclical factors could easily unwind, but for now, economists increasingly see structural factors winning out. Inflation is expected to hug the lower band of the RBI’s two per cent to 3.5 per cent forecast for the first half of the financial year, ending in March and remain below the 3.5 per cent to 4.5 per cent target for the second half.

Becoming anchored To be sure, India is benefiting from subdued inflation globally, especially in oil. Along with a 5.4 per cent rise in the rupee this year, the cost of imports have been held in check. Crucially, inflation expectations are becoming anchored. “Inflation expectations, both backward and forward, have declined,” said Pranjul Bhandari, chief India economist at HSBC Holdings. “Inflation each quarter is coming out to be lower than the previous quarter.” One-year forward inflation forecasts have fallen steadily since 2014, with underlying inflation — stripping out food, fuel, petrol and diesel — in the 4 per cent ballpark, which the RBI targets in the medium term, she said.

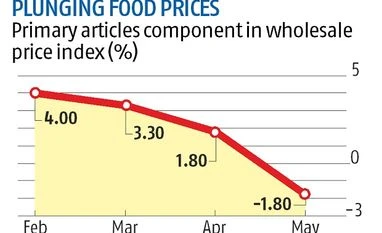

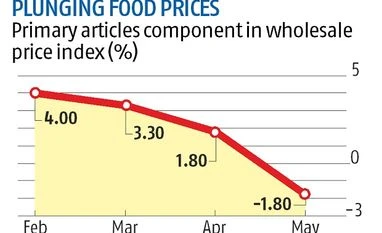

Adroit management Structural changes like better food management by the government and a muted rise in support prices for farmers have kept a lid on prices, economists say.

New base Last month, India also moved to new base year to calculate wholesale prices, bringing it in line with the 2012 base year of the consumer price index. This will reduce volatility in wholesale prices and provide a clearer signal for the RBI, said Soumya Kanti Ghosh, group chief economic adviser at State Bank of India, the country’s largest bank. Meanwhile, Bloomberg Intelligence economist Abhishek Gupta says that a raft of structural reforms, from the introduction of the goods and services tax on July 1, to easier foreign direct investment rules, should boost India’s growth potential over the longer term.

Bloomberg )

)