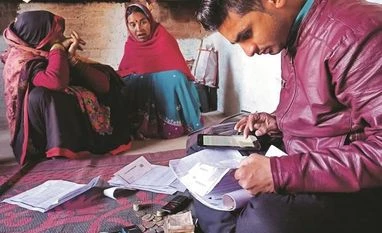

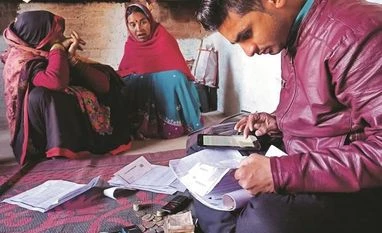

MFIs seek extension of credit guarantee scheme till FY2023

The industry body said smaller MFIs are finding it difficult to mobilise additional/new investment

)

Explore Business Standard

Associate Sponsors

Co-sponsor

The industry body said smaller MFIs are finding it difficult to mobilise additional/new investment

)

Microfinance institutions (MFIs) have written to Finance Minister Nirmala Sitharaman seeking extension of the credit guarantee scheme for micro lenders till FY 2022-23 with an amount of Rs 15,000 crore.

Of the amount, at least 75 per cent should be earmarked for small and medium-sized MFIs, Sa- Dhan, a self-regulatory organisation for the microfinance sector, wrote to the finance minister in its pre-Budget expectations.

The government is scheduled to present the Budget 2022-23 next month.

The industry body said smaller MFIs are finding it difficult to mobilise additional/new investment and hence requested support with subordinated debt having 5 to 7 years of tenure.

It also said SIDBI and NABARD should be allowed to issue tax-free social bonds for five years to exclusively provide debt /equity to MFIs operating in semi urban or rural areas.

Around 30 per cent of these funds can be in the form of equity and rest being debt.

Besides, the micro lenders have requested setting up of a Microfinance Development Fund of Rs 1,000 crore in NABARD to support not-for-profit MFIs with grant as well as revolving fund/refinance support.

"The Microfinance sector disbursed Rs 2,03,262 lakh crore last fiscal, which is close to 1.5 per cent of India's GDP. Therefore, the sector, if supported adequately in the upcoming Union Budget, can play pivotal role in reviving and steering growth and consumption, Sa-Dhan Executive Director P Satish said.

He said the government has supported the sector through various measures, including the credit guarantee scheme, during the challenging times of the ongoing pandemic.

However, the sector still faces few challenges in terms of higher credit costs and access to low-cost long-term funds, Satish added.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Jan 05 2022 | 8:12 PM IST