Thanks to a slowing economy and huge income-tax refunds, net direct tax collections in April stood at Rs 9,590 crore, 21.48 per cent lower than Rs 12,214 crore in the same month last year. Indirect tax collections saw only a meagre 3.5 per cent growth, as mop-up from Customs fell sharply on account of a drop in imports.

At Rs 24,110 crore, income-tax refunds given in April this year were 38.43 per cent higher than the Rs 17,416 crore refunded in the same month of 2013-14. Refunds are usually higher in the first month of a new financial year, as the tax department starts moderating it in the last quarter of a financial year to meet tax targets. However, in the past two years, net corporation tax collections in the first month were negative, as the tax department cleared the excess backlog of refunds in April.

“Collections are down due to refunds. It also implies that the economic situation has not improved yet,” said a finance ministry official who did not wish to be named.

Initial indicators for industrial growth in April did not seem promising, either. While official data for industrial production are yet to come, HSBC Purchasing Managers’ Index shows manufacturing activity in April might have been little changed from that in March. Also, non-oil, non-gold imports declined 3.9 per cent to $20.5 billion in April, against $21.35 billion in the same month a year earlier, showing industrial sluggishness was still there in the economy.

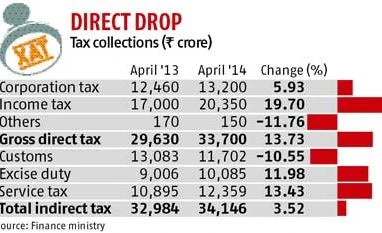

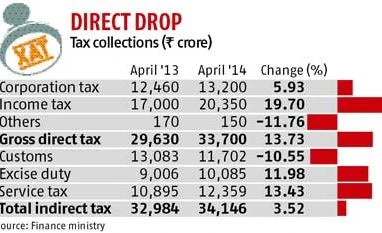

At Rs 33,700 crore, gross direct tax collections in April (including refunds) were 13.73 per cent higher than the Rs 29,630 crore in the year-ago period. Gross personal income-tax mop-up rose 19.70 per cent from Rs 17,000 crore in April 2013-14 to Rs 20,350 crore this year, whereas corporation tax increased marginally from Rs 12,460 crore to Rs 13,200 crore — an increase of 5.93 per cent.

Total indirect tax collections in the month increased a mere 3.5 per cent to Rs 34,146 crore, from Rs 32,894 crore in the corresponding month last year. A 10.6 per cent year-on-year drop in Customs duty collection — from Rs 13,083 crore last year to Rs 11,702 crore — affected the overall mop-up. In April 2013, Customs duty collection had increased 12.8 per cent from that the previous year.

“Customs mop-up is down due to a high base, huge refunds and a decline in imports, particularly of gold and oil. Excise is showing an increase because of low base, but manufacturing is yet to pick up,” said another finance ministry official asking not to be named.

Total imports in the month fell 15 per cent from those a year ago. Imports of gold, Customs duty on which was increased to 10 per cent, declined 74 per cent on an annual basis.

Excise duty collections stood at Rs 10,085 crore, 12 per cent higher than the Rs 9,006 crore collected in April last year, despite higher Cenvat credit and reduction in duty on automobiles and consumer durables. This might be due to low base, as excise mop-up had fallen 22.6 per cent year-on-year in April last year.

Service tax collections grew 13.4 per cent to Rs 12,359 crore, compared with Rs 10,895 crore in the year-ago period. The growth in April 2013 was 12.3 per cent.

In the interim Budget, the finance minister had projected a direct tax collection of Rs 7,58,421 crore in full 2014-15, growth of 19 per cent over last year’s Revised Estimate. For indirect tax mop-up, he had pegged a 19 per cent rise to Rs 6,17,377 crore.

These figures are likely to be re-estimated when a new government presents full Budget for 2014-15 towards the end of June or early July.

)

)