Bad loans haven't peaked yet: Rajan

Central bank plans IT subsidiary to check cyber frauds

BS Reporter Goa/Mumbai Bad loans in the banking system might not have peaked yet, Reserve Bank of India (RBI) Governor Raghuram Rajan said on Thursday, adding the central bank was working with lenders to recognise and address these non-performing assets (NPAs). He was speaking at a news conference after the central bank's board meeting in Goa.

Owing to an economic slowdown, the ratio of bad loans at Indian banks has doubled through the past three years, a worry for a country hoping to spur a revival in credit to key sectors such as infrastructure.

That has prevented banks from lending more, despite two interest rate cuts by RBI this year (totalling 50 bps). Banks that have announced earnings for the March quarter have reported a mixed trend in bad loans. "While some have managed to start bringing down their bad loans, at others, it is still increasing," Rajan said.

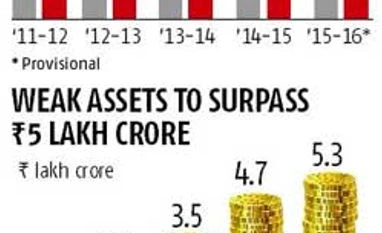

According to rating agency ICRA, the percentage of bad loans in the system is expected to exceed five per cent of the total this financial year.

"The removal of regulatory forbearance by RBI will raise gross NPAs to 5.1-5.7 per cent in 2015-16 from 4.5 per cent in 2014-15," ICRA said.

On the threat of cyber frauds, Rajan said RBI was planning to set up an information technology (IT) wing to face the challenge. "We've to worry about the increasing issues of cyber security; we've to worry about cyber supervision and with that in mind, the board suggested we focus on an IT subsidiary which would help us develop policies and capabilities in the areas of IT," Rajan told reporters.

He said the central board had talked about the changing nature of IT and the need for the monetary authority to keep abreast of it. "The changes are so rapid that one of the directors said 'today, we have banking which uses IT; tomorrow, it's going to become an IT company that does banking'," the governor said.

Rajan added the proposed IT entity's precise structure had to be worked out. Also, issues concerning systems such as cyber security, supervising the nature of technical capabilities of banks and new payment banks, which would be IT-intensive, as well as small finance banks, had to be addressed.

Rajan said RBI wasn't against the idea of an independent public debt management agency (PDMA), adding there was no difference of opinion between the central bank and the government on this issue. His comment follows the finance ministry dropping plans to set up an independent PDMA for now, saying it would conduct more consultation on the subject with RBI.

As of now, RBI manages the government's debt.

"I think we have repeatedly said we are not against the idea of a PDMA, which is suitably independent of all influences," Rajan said. "We will be in constant dialogue to see how we can make it function effectively."

)

)