FII investment surges in Indian debt

Experts say many sold US debt and bought Indian paper due to the narrowing spread between retail inflation in the two countries

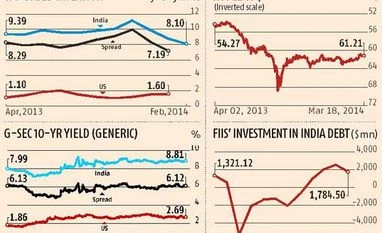

Neelasri Barman Mumbai Foreign Institutional Investors (FIIs) were the largest category of investors in Indian debt last month, of $2,555 million.

Experts say they sold US debt and bought Indian paper, due to the narrowing spread between Consumer Price Index (CPI)-based inflation in the two countries and a widening spread between the 10-year government bond yields in both.

The Reserve Bank of India (RBI)’s focus is now more on CPI-linked inflation, as recommended in the Urjit Patel committee report.

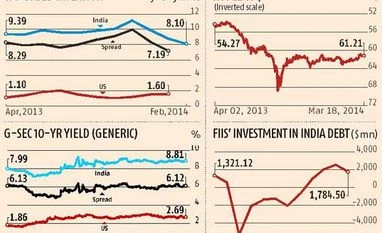

Retail inflation eased more than expected, to a 25-month low, in February, when it has risen 8.1 per cent from a year earlier, compared with 8.79 per cent in January.

A spread of at least 6.2 per cent between the yield of 10-year Indian and US government bonds is considered good. “In the Indian context, the sentiment has improved on inflation and rupee volatility. The belief is there will be a squeeze in the inflation differential between India and the US, and rupee depreciation, to maintain the historic normalisation of 3-3.5 per cent per annum. This expectation has established a bond spread of 6-6.25 per cent between the 10-year yields,” said J Moses Harding, group chief executive officer, liability and treasury management, at Srei Infrastructure Finance.

The spread between retail inflation of India and the US was 9.96 in November, 8.37 in December and 7.19 in January. This is a positive sign for attracting FII flows in bonds.

“FIIs are investing in Indian paperbecause they are getting comfort from inflation coming down. Their investments in India bonds will depend on the issuance calendar and the CPI-based inflation data,” said Anoop Verma, vice-president (treasury), Development Credit Bank.

The issuance calendar for marketable dated securities for April-September 2014 is expected this month and the Street expects 60-66 per cent of the year’s gross market borrowing of Rs 5.97 lakh crore to be completed by September. This might translate into government bond auctions of Rs 15,000-17,000 crore weekly in the first half of the next financial year (which starts on April 1).

Since CPI-based inflation has been coming down, the Street expects the RBI monetary policy review on April 1 to keep interest rates as these are. This would give comfort to the bond market.

)

)