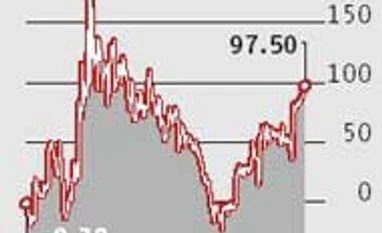

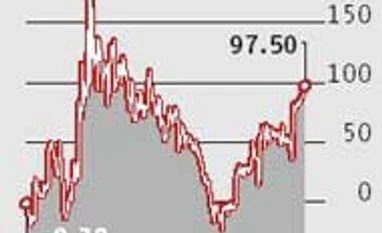

Gilt, repo spread widens

Nears 100 bps on worry about impact of Bihar poll results, plus rising bond yields in US & Europe

BS Reporter Mumbai A day after the ruling National Democratic Alliance's defeat in the Bihar assembly elections, the spread between the benchmark 10-year government security yield and the policy repo rate touched 100 basis points (bps).

This happens only when the market is stressed. “The election results induced a perceived political risk in the equation. Even as the government at the Centre remains strong, reform measures could be hit. Foreign investors do not like such uncertainties,” said Soumyajit Niyogi, interest rate strategist at SBI DFHI, leading primary dealer in the debt market.

Bond dealers also attributed the widening gap to robust non-farm payroll data in the US, which raised the probability of a Federal Reserve rate increase next month.

The 10-year bond yield opened at 7.745 per cent, almost a full percentage point higher than the Reserve Bank's repo rate of 6.75 per cent. The earlier occasion when spreads widened to 100 bps was at the beginning of financial year 2014-15. In the first week of April 2014, the spread widened to as much as 110 bps, after the government started borrowing from the market.

Between August and November 2013, the spread had consistently remained above 100 bps, when the rupee had depreciated rapidly, falling to a record low of 68.85 a dollar on August 28, with RBI battling high interest rates in the money markets.

On Monday, the gilt-repo rate spread fell as low as 99.5 bps, closing at a spread of 97.5 bps. The yield at Monday's close was 7.727 per cent against 7.686 per cent on Friday. Bond prices and yields move in opposite directions.

“A spread of this size is unusual. Local bonds are adjusting to the rise in US bond yields after their non-farm payroll data (announcement),” said N S Venkatesh, chairman, The Fixed Income Money Market and Derivatives Association of India, and executive director at IDBI Bank.

Rupee

The weakness in equities and bonds, along with the dollar appreciating against most Asian currencies, reflected in the rupee, closing sharply down at 66.45 against the dollar. On Friday, it had closed at 65.76. Devendra Dash, senior bond trader with DCB Bank, said Bihar’s election results had certainly dampened the sentiment. “Overall, the sentiment is negative, as foreign investors will likely lose out on the rupee and the market fears these investors could offload some local bonds,” he said.

On Monday, most Asian currencies fell against the dollar. While the rupee fell about one per cent, the Malaysian ringgit led the pack, falling almost 1.5 per cent.

)

)