Banks back alternate bucks before Brexit

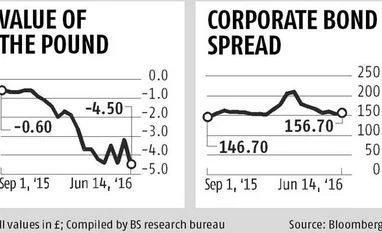

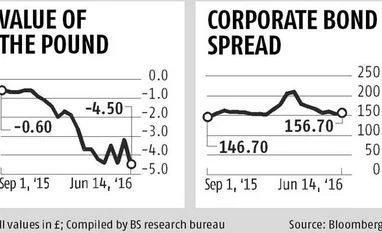

Bloomberg The UK's referendum on European Union membership is spurring volatility in the pound, making trading sterling increasingly expensive. Banks are pointing clients toward alternative currency bets or hedges that could fare well regardless of the outcome.

Here is a list of analysts' favourite trades as written in research notes or recommended in interviews conducted by Bloomberg News in recent days.

Bank of America Merrill Lynch The curve in the euro against the yen is the most inverted at the front end since the financial crisis, according to Christopher Xiao. The strategist said investors expecting a turmoil-less vote can take advantage of the curve by selling summer volatility and buying fall volatility.

Goldman Sachs Group Inc Betting in a decrease in the value of the pound and the euro against the Swiss franc are both expected to perform well in the event of a "leave" vote, strategists including Silvia Ardagna wrote in a June 7 note. The analysts do not favour selling the pound against the yen given the risk that the Bank of Japan could ease monetary policy further, weakening the currency.

JPMorgan Chase & Co The bank expects the spot market to build in a renewed premium going into the vote, and increased its short position in the pound against the yen on June 3, adding to an existing cable put spread, strategists including Paul Meggyesi wrote in note dated June 7.

Morgan Stanley Strategists including Hans Redeker advise selling the euro against the dollar with a target of 1.08. The idea is based on the view that one month volatility is still not pricing enough downside risk for the euro, they said in a note dated June 13.

Societe Generale SA Going long the Swiss franc against Norway's krone may be the best trade to hedge against the risk of an exit, according to Kit Juckes, as a decision to leave would be bad for all the higher-beta currencies in Europe including the krone.

)

)