Global food prices jump in June

Highest monthly average rise in 4 years; sugar and maize take lead

Dilip Kumar Jha Mumbai Prices of agricultural commodities jumped in June, the steepest monthly rise in four years, on supply concerns in some 'sensitive' products such as sugar, pulses and maize in major producing countries.

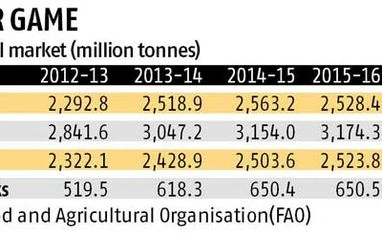

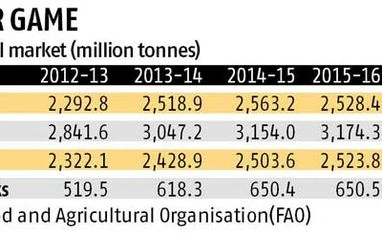

Data from the Food and Agricultural Organisation (FAO) of the United Nations showed food commodities’ prices in global markets rose 4.2 per cent to 163.4 points in June as compared to 156.7 points in May, their highest rise since 2012. While the global Food Price Index showed a sharp jump in June, it witnessed a one per cent decline from the 164.9 points shown in June 2015.

The June rise, which affected all commodity categories except vegetable oils, was the fifth monthly increase in a row, following a sharp decline in global production estimates of sugar and maize.

“Except for vegetable oils, the values of all the commodity sub-indices moved up, led by a surge in the price of sugar and more moderate increases for cereals, dairy and meat,” said FAO in its latest monthly report on Thursday. The FAO Cereal Price Index rose 2.9 per cent in the month and is now 3.9 per cent below its level of June 2015. Maize prices drove that increase, primarily due to tightening export supplies from Brazil. Ample wheat supplies and reports of record yields in America held down prices.

FAO has revised its global maize production forecast downwards, due to unfavourable climatic conditions. Prospects for a second crop in Brazil have dimmed and reduced government support in China led to lower planting.

Overall, coarse grain production for this year is now expected to be 1,316.4 million tonnes (mt), 0.6 per cent lower than last month's forecast. Global wheat production, however, is now pegged at 732 mt, a little more than one per cent higher than anticipated in June, mainly due to improved prospects in the European Union (EU), Russia and America, as a result of better weather conditions.

As a consequence, world cereal production for 2016 has been revised to 2,544 mt, about 0.6 per cent (15.3 mt) higher than the 2015 estimate and fractionally above the previous month’s forecast. Prospects mainly improved for wheat but also for rice and barley.

Thus, world total cereal utilisation in the 2016-17 marketing year is now projected at 2,555.6 mt, 1.3 per cent higher than the estimate for 2015-16. As a result, global cereal stocks by the end of the farming season in 2017 are expected to be 635 mt, 1.5 per cent below their opening level. The resulting world stocks-to-use ratio for cereals would stand at 24.2 per cent in 2016-17, compared to the 2007-08 historical low of 20.5 per cent.

The FAO Sugar Price Index rose 14.8 per cent from May, as Brazil, the world's largest sugar producer and exporter, endured heavy rains that hindered harvesting and dented yields. In fact, global sugar consumption is estimated to contract production by a little over four mt in 2016-17. Data compiled by Bloomberg showed prices had surged to cents 20/lb in the benchmark Chicago Mercantile Exchange in June, from 17/lb a month before.

The FAO Dairy Price Index rose 7.8 per cent from May, spurred by an uncertain outlook in Oceania and slower production growth in the EU. Nonetheless, the index remained 14 per cent below its level of a year before. The FAO Vegetable Oil Price Index defied the trend, declining 0.8 per cent from May.

)

)