SureWaves: Getting local

The Bengaluru-based firm ties up with Hansa Research for a real-time audit of ad spends on its 450 local cable channels

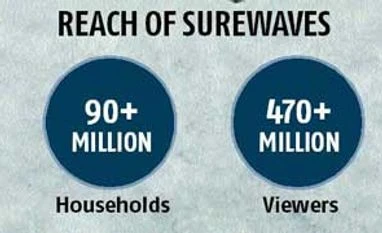

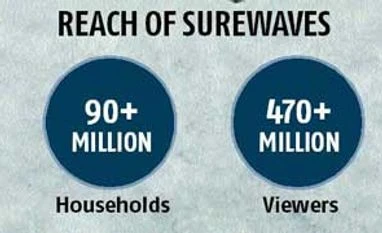

Vanita Kohli-Khandekar New Delhi How local can TV get? In 2011 Bengaluru-based SureWaves MediaTech used Rs 10 crore of venture funding to do to television what digital cinema did to film theatres, aggregate local cable channels. Three years later more than 100 advertisers such as Hindustan Unilever, Dabur, Vodafone and GSK among others reach out to 90 million homes in 29 states using the 450 channels that SureWaves offers. This includes 21 local cable channels in a region that marketers are really keen on - the North-East of India. So far advertisers only had Guwahati numbers as a representation of a region with seven distinctly different states.

Earlier this week SureWaves entered into an association with Hansa Research for a real time audit of ad spends on its network. This essentially means that marketers who spent a reported Rs 50 crore through SureWaves can now check whether the ad appeared and how many people it reached. While SureWaves (which raised an additional Rs 35 crore earlier this month) is footing the bill for the audit now, eventually an independent service should take off. The availability of an audit service could help push up local advertising, reckon analysts.

Of the Rs 45,000 crore that was spent on all marketing activities in India in 2013, more than 40 per cent went to events and on-ground activities among other things. Many of these help reach audiences in media dark markets or ones that are underserved by mass media. Ten years back they did not matter. But as the growth engine of the Indian economy shifts to small-towns and rural India, reaching these consumers gets more important. Mandar Patwardhan, COO, SureWaves points to product categories with 100 per cent penetration, say toothpaste, which reach only 60-70 per cent of the market through 160 million cable and satellite homes.

To this add local retail advertising, a huge and growing part of the game. Going by most estimates local retail advertising, which doesn't get reflected in the Rs 36,000 crore national ad figure number would be around one-fifth of it.

Both these factors - the national advertiser' need to go local and the local ones' need to connect better - explains why newspapers are launching hundreds of sub-editions or radio stations are keen on getting into C and D class towns. But television has largely been unable tap into this growth since the slicing it offers is more by genre or language. So a Reliance Broadcasts' Big Ganga or Mahua works the Bihar market, but if ad advertiser wants to reach only the audience in Gaya or Bhagalpur then these regional channels don't make sense.

In the US for instance roughly one-fifth of the money spent on television comes from local advertising. India has thousands of local cable channels - like CCC or CVO you see in Mumbai - in almost every city and town. Together these account for 4 per cent of national time spent viewing television. These then seem like a logical way to connect with specific local audiences. There are however two issues with these.

One, they are very fragmented. Usually marketers have to buy time on them individually much like they bought ad rights to India's 11,000 odd theatre screens. It is only when firms such as UFO Digital Cinema or Real Image came that advertisers could buy say a 2,000-3,000 screens at one go across states and languages. A SureWaves station at local cable headends is the conduit through which the channel goes. This helps to insert, place and track the ad. It is the first step towards aggregating this fragmented audience.

The second issue is, "one of measurement and trust. Was my ad carried and how effective was it?" asks Anuj Gandhi, group CEO, IndiaCast Media Distribution, the distribution arm for Viacom18. This is where SureWaves tie up with Hansa helps.

Gandhi reckons that India's pathetic ad to GDP ratio (half per cent against 1-1.5 per cent for most countries) can be bridged if local and retail advertising comes into play fully. And the tie-ups like the one between SureWaves and Hansa could be a small step in that direction.

)

)