80:20 scheme for gold import set for revamp

Several cases of misuse of the scheme found, need felt to make import transparent

Rajesh Bhayani Mumbai With gold imports on the rise again, officials of the revenue department and other government agencies feel the 80:20 scheme, wherein out of every 100 units imported, 20 units have to be exported, should be revamped. Several cases unearthed by agencies reveal that the scheme is being grossly misused by traders.

Sources said the government is considering whether to do away with the scheme and fix a quota for imports and de-linking it from exports or overhaul the scheme. The decision might come soon, as imports are on the rise and the marriage season is round the corner, resulting in higher demand, especially when prices have fallen significantly.

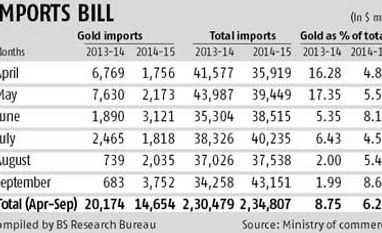

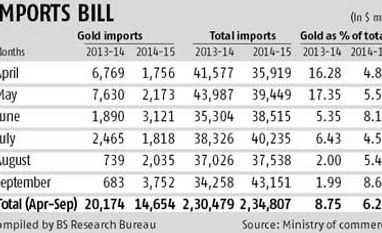

Gold imports in September was $3.75 billion, at least $1 billion more than previous months and in October also imports were at an elevated level.

A government official said the scheme was introduced with a view to ensure net imports of gold don’t become a burden on the country’s current account.

“But several instancces of export of substandard or even fake gold jewellery had been unearthed, which proved that the scheme is being misused,” said an official.

Three Mumbai-based jewellers had been issued show-cause notices and they have approached the settlement commission. They were found to be exporting gold-plated ornaments. The official quoted above said, “What was going out of the country was not gold. Even when machine-made gold jewellery is exported and value addition is negligible. This is done to get higher import eligibility.”

According to officials, it is difficult to decipher fake jewellery, as caratometer, instrument used to test purity of gold, can test only the surface of ornaments. Round-tripping of gold was rampant earlier also, but now that is used to get higher eligibility to import gold under the 80:20 scheme.

Even smuggling has become rampant, as gold availability was scarce. Besides, a premium has to be paid for physical delivery of gold and a 10 per cent import duty. To finance smuggling, hawala route was the preferred option and hence premiums have increased and quoted in the range of three-four per cent. However, a diamond trader from Surat, Gujarat, was caught remitting foreign exchange multiple times for one import consignment. The modus operandi was that the trader was using an official channel to send money abroad and he used to use multiple copies of a bill of entry to make multiple payments from different banks/authorised dealers for same import consignment. This was done to finance gold smuggling.

To stop misuse, the scheme should be simple to implement and supervise.

Hence, experts are considering various options such as fixing an import quota and allowing only banks to import. Recently, several bullion traders have conveyed to revenue department officials that they favour import quota for gold, which will be easy to supervise and help keeping a watch on current account and quota can also be changed depending upon flexibility permitted by balance of payments.

)

)