Amtek Auto shares jump on back of buying interest

Bloomberg Mumbai Amtek Auto shares surged after the cash-strapped Indian auto-parts maker said it has received a lot of interest for the minority stakes in overseas units that it put up for sale to raise funds and cut debt.

Amtek expects to finalize the deals in the next 12 months, John Flintham, senior managing director of the New Delhi-based components maker, said in an interview with Bloomberg TV India. The sale of stakes of as much as 40 percent will constitute about half of the company's debt-reduction plan, he said.

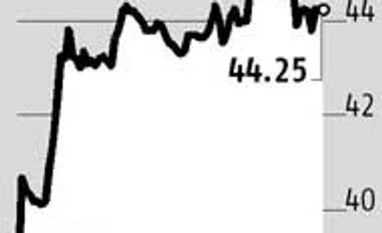

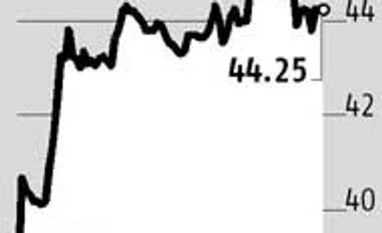

The company's shares jumped 14 per cent, the most since September 11, to Rs 44.20 in Mumbai.

The supplier to automakers including Ford Motor Co and Maruti Suzuki India missed a deadline to pay Rs 800 crore ($122 million) of bonds in September. Flintham said more than half of the banks have agreed to Amtek Auto's debt reduction plan and expects the rest to agree by end of this month.

The auto-parts maker gets about 43 per cent of its revenue from overseas, according to an investor presentation in April. The company, including units, has reported negative free cash flows for the past decade and has completed acquisition of eight assets mostly overseas since the start of 2013.

Amtek on Monday said it has appointed Morgan Stanley as adviser to help with the debt reduction plan.

)

)