BPCL: FY14 may see fresh triggers from E&P

While slower-than-expected pace in oil reforms have led to OMC stocks correcting from 52-week highs last month, Bharat Petroleum’s exploration & production assets should drive valuations

Ujjval Jauhari Mumbai

If Wednesday’s reports of ONGC planning to buy Videocon’s 10 per cent stake in the Mozambique block for $3 billion are any indication, there are potential gains for Bharat Petroleum Corporation Ltd’s (BPCL’s) stock (by about Rs 50 per share). Analysts so far have been valuing BPCL’s 10 per cent stake in the same block at an average $2 billion; if Videocon’s deal takes place reasonably above the $2 billion mark, it should have a positive rub-off on BPCL. Nevertheless, given its exploration and production (E&P) focus, analysts prefer BPCL among the oil marketing companies (OMCs) and suggest the recent decline in the share price provides a good entry point.

OMC stocks had seen a sharp rally in January, hitting 52-week highs on hopes of fuel price reform gaining momentum after the Kelkar committee report. However, the rally fizzled out as the government allowed diesel price hikes in a phased manner and in small quantities. Also, diesel and kerosene price rises are politically sensitive issues and with elections fast approaching, analysts say after the initial price hikes the uncertainties would remain over further hikes and till complete decontrol of diesel prices taking place.

Alok Deshpande at Elara Capital observes that BPCL’s differentiating factor of E&P valuation gives it a strong floor of around Rs 350 a share levels even in the case of negative news flow on reforms. Adding to this, the upside potential of around Rs 60 a share from its Brazilian E&P stake as well as from additional reforms, it leads Deshpande to a target price of Rs 500 for BPCL. The target price of other analysts range at Rs 445-500, which given the current price of Rs 393, indicates potential upside of 13-27 per cent.

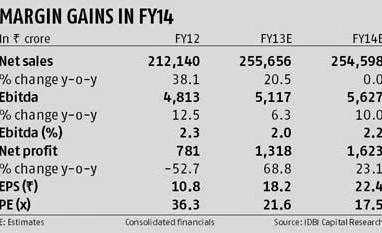

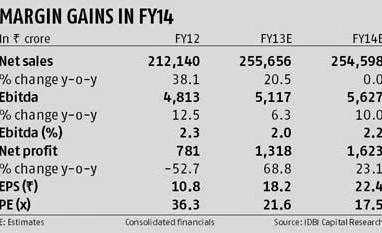

Prices inching up, but analysts sceptical OMC stocks got some momentum this Monday onwards as diesel and petrol prices were raised by 45 paise and Rs 1.5 a litre over the weekend, taking the total hike to about Rs 1 and Rs 2, respectively in 2013. Such moves, if sustained, should help ease pressure on the financials. Says Sudeep Anand of IDBI Capital, “Due to recent reform moves and expectation of Rs 2.7 per litre diesel price hike in FY14, we expect the company’s liquidity scenario to improve. Also, as the company received all dues from the government in January 2013, its debt burden is likely to decline significantly going forward, which was at Rs 30,900 crore at the end of the third quarter.”

However, OMCs are bearing a loss of more than Rs 10 a litre on selling diesel at subsidised prices, while breaking-even in petrol.

Though the government said OMCs would raise diesel prices by 50 paise a litre every month (totalling Rs 6 per litre annually), analysts are expecting a cumulative diesel price increase of not more than Rs 3-4 a litre over FY14. While the Kelkar Committee had suggested an immediate hike in fuel (diesel, LPG and kerosene) prices and complete deregulation of diesel prices by the start of 2014-15, the chances of deregulation are low for now, believe analysts.

Analysts at Axis Securities (earlier Enam Securities) in their report dated February 15 observed the road map to diesel price deregulation, along with direct transfer of cooking fuel subsidies, could benefit OMCs. However, lax implementation would be a risk, given the busy election calendar in 2013. Also, budgetary proposals such as five per cent customs duty on crude oil and shift to export parity prices would be hugely negative for OMCs. Higher interest costs and ad-hoc subsidy sharing remain overhangs.

E&P holds promise

Meanwhile, the company continues its E&P activities in different geographies around the world. With these activities, it gains place in upstream assets, apart from its downstream activities of marketing and selling fuels. BPCL’s upstream portfolio, spanning 26 assets in seven countries, has proved a game changer. In the Mozambique block (the key asset in E&P portfolio), two major gas discoveries have been made, indicating recoverable reserves of 15-35 trillion cubic feet of gas. These estimates could get a fillip as the consortium drills undertake further exploration.

Analysts at Barclays expect news flow for BPCL to remain supportive in 2013-14, as its consortium drills more exploration and appraisal wells in Mozambique and Brazil. Analysts say the BPCL consortium will drilling 10 wells in Mozambique and eight wells in Brazil in FY14. Additionally, the Mozambique LNG project investment decision will also be taken by end-2013 with target for commercial output by 2018, while clarity will emerge on the E&P resource base and monetisation plan in Brazil.

)

)