Chinese probe into shadow banking spooks copper market

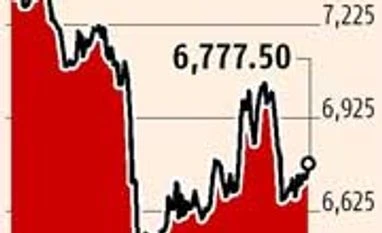

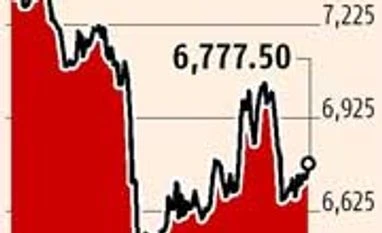

Kunal Bose At a three-month forward price of $6,730 a tonne at the London Metal Exchange (LME), copper has fallen about 10 per cent so far this year. The fall is principally attributed to two factors: First, the World Bank has scaled down its forecast for global growth from 3.2 per cent to 2.8 per cent, as the fact that the US, China and Russia are likely to report weaker growth than expected is leading to worry among operators. But what is leaving a bigger impact on the market is Beijing looking closely at fraudulent financing deals using metals, principally copper and iron ore, stored at warehouses at the Qingdao and Penglai ports.

This is seen as part of Chinese Prime Minister Li Keqiang's drive to curb shadow banking. A trained economist, Li wants to keep shadow banking under check, before the country faces its 'Lehman moment'. What is probably worrying him the most is the ballooning of lending, which, according to Standard Chartered Bank, is 231 per cent of gross domestic product (GDP), and a series of failures by borrowers to repay loans, including bond redemption. Estimates vary on the size of the shadow-banking segment, whose phenomenal growth in recent years is due to the fact that the Chinese central bank has put restraints on banks in lending to sectors such as mines, house construction and steel.

Shadow institutions are primarily in the form of trust companies, but tied to the apron strings of licensed banks and manufacturing companies in need of credit. Sponsoring bank-like organisations could mobilise funds on a large scale, as regular banks will offer returns as little as 0.35 per cent on savings accounts. No wonder individuals are leaving their money with financial groups offering returns of about 10 per cent. Defaults occur when businesses of borrowers go bust, as has been the case with some coal miners, in the wake of major declines in global coal prices.

Li had cautioned against more defaults when in March, China's onshore bond market had recorded its first default, as solar cell maker Chaori failed to pay full interest on its debt instruments. This proved unnerving for the global financial market.

Bank of England Governor Mark Carney had described shadow banking in emerging markets as a potential trigger to destabilisation in the global economy. The Economist says watchdog Financial Stability Board "defines shadow banking as lending by institutions other than banks", which it "reckons accounts for a quarter of the global financial system, with assets of $71 trillion at the beginning of last year, up from $26 trillion a decade earlier. In some countries, shadow banks are expanding even faster: In China, for instance, these grew 42 per cent in 2012 alone". Emerging market shadow banks have come to occupy a big space, as regular banks are increasingly coming under strict regulations and are being barred from extending further credit to sectors facing rough weather. Li, it appears, is on the same wavelength as The Economist, which says shadow banking is "huge, fast-growing...a powerful tool...if carelessly managed, potentially explosive".

As is the case with other metals, any problem besetting China will leave a major impact on copper. This is because China accounts for 42 per cent of global consumption of the metal. Alarmed by payment defaults by borrowers from shadow-financing entities finally recoiling on the regular banking system and reports of borrowing groups pledging the copper held at port warehouses more than once, Beijing has started plugging the loopholes. Initiation of probes into fraudulent use of the same collateral for multiple loans to work around increasingly strict bank lending standards has put copper prices under pressure. There are reports some banks and dealers have lost appetite for metal-financing deals. Metals, including copper, have started moving from warehouses in China to safer havens, including the vast LME stockrooms across countries. Copper producers, seeing their margins squeezed because of unsavoury developments in the world's biggest market for the metal, are hoping instead of disorderly dumping of stocks, tre will be gradual unwinding of metal-financing deals. Copper is in a bear phase, which is unlikely to go away soon.

Speaking to Reuters Global Base Metals Forum, Caroline Bain of London-based economics research consultancy group Capital Economics says, "Our forecasts assume the unwinding of the deals (Chinese metals financing) will put pressure on copper prices in the third quarter. We have a forecast of $5,800 a tonne for copper at the end of the third quarter." At the same time, weak economic data from primary consuming countries, particularly China and the US, are hurting copper prices. All this is happening when copper is found to be globally oversupplied, as some long-gestation greenfield mine projects in South America and central Africa have come on stream. Deutsche Bank says the copper market will continue to have modest surplus of up to 500,000 tonnes through the next three years. An improvement in the supply of copper concentrate feedstock is, however, bringing good tidings for import-dependent Indian smelters. Earnings of standalone smelters are linked to treatment and refining charges (TCRC) embedded in concentrate prices. TCRC tends to rise in times of easy supply of concentrate.

)

)