Edible oil import bill to rise 15-20%

Dilip Kumar Jha Mumbai India's edible oil import bill is likely to rise by 15-20 per cent this oil year (November '15-October '16), on a sharp increase in the price of crude palm oil (CPO) in global markets and a widening supply deficit here.

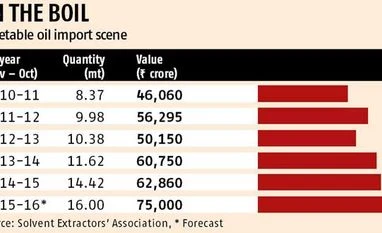

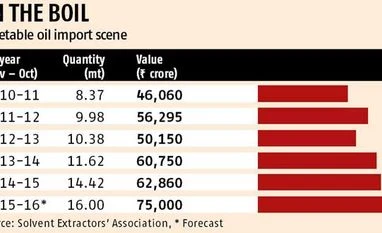

A fall in production from local sources, and a spurt in demand on subdued prices over the past year, has widened the deficit in India. the country imported 14.5 million tonnes of vegetable oil (edible and non-edible) worth Rs 60,000 crore in oil year 2014-15. This is likely to rise to 16 mt worth Rs 75,000 crore by the end of the current oil year in October.

The CPO price in November was around 2,100 ringgit a tonne in Malaysia, after declining to a several-years low of 1,800 ringgit a month before. It recovered from this to trade currently at 2,685 ringgit a tonne. From the lowest level, the price is up 49 percent"Considering the average price rise of 10 per cent and a similargrowth in volume of import, India's edible oil import bill will jump by up to 20 per cent this year," said B V Mehta, executive director, Solvent Extractors' Association (SEA), apex body of the edible oil industry.

Its data shows vegetable oil import at 6.27 mt worth Rs 27,990 crore between November 2015 and March 2016. For the full oil year, as mentioned earlier,import is estimated to be 16 mt, worth Rs 75,000 crore. Prices are likely to remain firm through this year on reduced supply from the world's top two producers, Indonesia and Malaysia, due to adverse climatic conditions. Dorab Mistry, director at Godrej International, estimates CPO production in Malaysia could fall by 1.5-2 mt to 19 mt. Output in Indonesia is estimated at 31 mt. The two together produce 86 per cent of global palm oil. "With excess rainfall forecast this monsoon, there is hope for higher kharif oilseed output this year. However, the edible oil import bill would continue to rise on increasing domestic demand," said Atul Chaturvedi, chief executive at Adani Wilmar, the Fortune brand producer, of the total import basket, imports around a third of refined oil and the remaining two-third of CPO.

)

)