External events might decide if the uptrend will continue

Devangshu DattaA surprise rate cut enabled the stock market to break out of a trading range lasting several weeks. Based purely on domestic signals from the Indian markets, we could expect the bull run to strengthen. At only 25 basis points, the Reserve Bank off India's out-of-turn rate cut was minimal but promised to start a trend. Between now and the Budget, sentiment about the Indian economy is likely to be positive.

The danger is external. Asian markets are nervous about China and Europe is waiting for a quantitative easing expansion programme from the European Central Bank (ECB). If China's gross domestic product numbers are worse than expected, or if the ECB disappoints, some bearishness will be introduced.

The Nifty jumped past 8,450 and kept going up; the main driver has been financial stocks, including banks and non-banking financials. The Bank Nifty has moved up to a succession of new all-time highs. Given the high weight of bank stocks in the Nifty and the high-correlation, high-beta nature of the Bank Nifty, it's expected the Nifty will also break out to new all-time highs of more than 8,625.

In the past three sessions, the attitude of foreign institutional investors was positive, with net buying. While that of domestic institutional investors has been negative (net selling). Volumes are moderate and the breadth is positive, with advances outnumbering declines.

The rupee has strengthened against the dollar. It could also strengthen against the euro if the ECB announces quantitative easing. End-of-the-month buying by oil-marketing public sector undertakings will lead to some pressure, with the rupee likely to ease against the dollar.

For several weeks, the Nifty meandered within a trading range, moving in a 300-point zone of 8,150-8,450. On a wider time frame, there has been a lot of trading between 7,900 and 8,600 in the past four months.

The current breakout should mean a move past 8,627 (the all-time high), confirming the big bull market is alive. The Bank Nifty's movement and the breakout suggest targets in the region of 8,750 could be hit. Short-term traders might assume congestion at every 50-point interval.

The Bank Nifty is obviously in a strong uptrend. As it's in new territory, target setting is impossible. Traders who take long positions in either Bank Nifty futures or options should be prepared for a reaction to trigger short-term pullbacks till 19,100. Stop-losses should be set accordingly.

Expiry effects will be evident soon, as the Republic Day will curtail the number of session till settlement. The Nifty 'call' chain has open interest (OI) peaking at 8,700c, with a slightly smaller OI bulge at 8,600c. There is ample OI till 9,000c. The 'put' OI is very high at every 100-point strike between 8,000p-8,500p. At 1.6, the put-call ratio is abnormally high for January; it is 1.4 for a three-month range. This could signal a short-term correction.

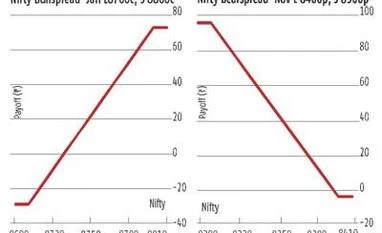

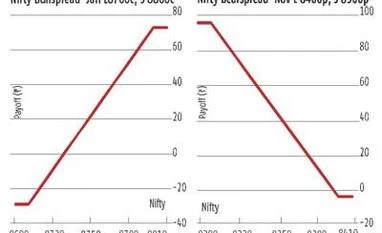

On Monday, the spot Nifty closed at 8,550, with the futures at 8,578. The close to money (CTM) bearspread of long 8,500p (62) and short 8,400p (38) is attractive, costing 24 and paying up to 76. A wider bearspread, with long 8,400p (38) and short 8,300p (24) could also be hit; this costs only 14. The CTM bullspread of long 8,600c (73) and short 8,700c (34) is acceptable, with a cost of 39. A wider spread with long 8,700c (34) and short 8,800c (13) costs 21.

A strangle combination of long 8,700c and long 8,400p; and short 8,800c and short 8,300p, costs 35 and breaks even at 8365, 8735. Despite the relatively short time to settlement, there are high chances the wider spread will pay off in either or both directions.

)

)