Fall below 8,280-8,440 a negative signal

Devangshu DattaThe Reserve Bank of India (RBI) held status quo at the last policy meet but Governor Raghuram Rajan hinted the central bank may consider another rate cut. The Nifty has held its ground above 8,500 for the past fortnight. The breakdown on Sunday could signal the start of a short-term downtrend.

The July Inflation numbers will influence sentiment and so will the IIP. But the FII focus will more likely, be on the possibility of the US Fed action and developments in China. There is some disappointment that the monsoon session of Parliament has been frittered away.

Volatility expectations are down, given several sessions of low-amplitude trading. The Nifty has tested and failed to break out beyond resistance in the zone of 8,625. On the downside, it has successive supports at 8,500, 8,450, 8,400, etc. The simple 200-Day Moving Average (200-DMA) is around 8,440 and the exponential average is at 8,280.

If the index falls below 8,280-8,440, it would be a negative signal. Volumes remain low and advances were outnumbered by declines on Monday. The market was supported last week by net FII buying. If sentiment changes in that quarter, there could be a sharp drop.

The Bank Nifty hit highs of 19,100 twice in successive sessions after the credit policy. But it has reacted from that zone. It could retract till the 18,150-18,200 level if State Bank of India's (SBI's)results are disappointing, since that is now the key result pending in the sector. In general, results have been along expected lines with several public sector banks taking higher provisioning against non-performing assets. If SBI beats consensus, the Bank Nifty could rise but a fall looks more likely, since most of the sector is bearish.

It seems a reasonable gamble to take a bearspread of long 18,500p (147), short 18,000p (51) on the Bank Nifty. Only two moderately bearish sessions could result in the 18,500 being struck and risk:reward is quite tempting with a cost of 96, versus potential maximum return of 404. The rupee has remained stable, mainly due to FII inflows. There could be turmoil in forex markets during the last stages of this settlement given that traders fear an interest rate hike by the Fed in September.

It's hard to call the trend at the moment and it's possible that range-trading will continue with the markets seeking some sort of trigger. The Nifty's put-call ratios (PCR) are at positive levels, with PCR at 1.12 for one-month and 1.10 for three-month data. The Nifty's call chain for August has big peaks at 8,700c, 8,800c and 9,000c. The put chain for August has peak open interest (OI) at 8,200, with high OI at all strikes between 7,900p and 8,500p.

Premiums have reduced across the August chains, partly due to the settlement going into second week, and partly because of the range trading. The Nifty was held at 8,525 on Monday, with negative carry on the Nifty futures (and the Bank Nifty futures as well).

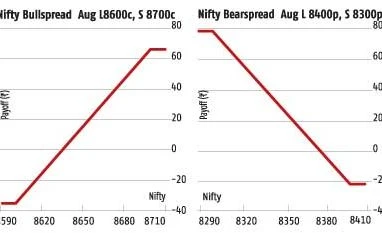

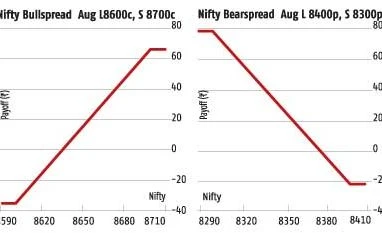

Close to money, a bullspread of long 8,600c (72), short 8,700c (36) costs 36 and pays a maximum 64, at about 75 points off the money. A wider bullspread of long 8,700c, short 8,800c (16) costs 20. A near-the-money bearspread of long 8,500p (83), short 8,400p (52) costs 31 and pays 69, at only 25 points from money, A wider bearspread of long 8,400p (52), short 8,300p (31) costs 21 and pays 79. Either of the bearspreads could work, and so could the bull; spread.

Combined, a long-short strangle of long 8,400p, short 8,300p, long 8,600c, short 8,700, costs 57 and pays 43 with breakevens at 8,343, 8,657. This is not too attractive and it's not zero-delta because the puts are more distant.

)

)