FIIs sold Rs 5,000 cr of PSU stocks in Q2

ONGC, State Bank of India, Gail (India), NTPC and Container Corporation of India are some of the frontline stocks that FIIs sold

Deepak KorgaonkarPuneet Wadhwa Mumbai / New Delhi Foreign institutional investors (FIIs) sold equity shares worth nearly Rs 5,000 crore in public sector undertakings (PSUs), including banks, in the July–September quarter.

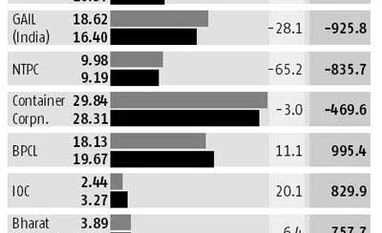

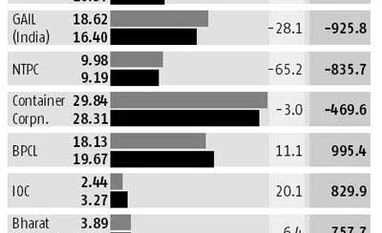

Shareholding pattern data filed by 47 PSUs with stock exchanges reveal FIIs offloaded a net Rs 4,886 crore in equities during the quarter, second (Q2) of the financial year. They sold shares worth Rs 8,375 crore of 31 companies and bought shares amounting to Rs 3,489 crore.

Also Read: FIIs cut stake in PSBs in Sept quarter

The calculation is based on a company’s average market price in Q2, as the exact date of share transaction by these investors could not be ascertained. The S&P BSE Sensex had slipped six per cent during the quarter, its sharpest quarterly decline since December 2011.

Oil and Natural Gas Corporation (ONGC), State Bank of India (SBI), GAIL, NTPC and Container Corporation of India were some of the frontline stocks sold. However, the FIIs bought equity shares of Bharat Petroleum Corporation, Bharat Electronics and Indian Oil Corporation.

Also Read: FinMin seeks 30% dividend from profit-making PSUs

“Any fund manager will be negative on these stocks. A fall in the price of crude oil has seen investors dump ONGC. On the other hand, there has not been a significant drop in the non-performing assets of Bank of Baroda, Punjab National Bank and SBI. That’s why investors have exited these counters. GAIL has its own set of problems with the LNG (liquefied natural gas) business segment. So, any fund manager after looking at the fundamentals will try and rebalance the portfolio by exiting these stocks and buying those where there is earnings growth visibility,” says G. Chokkalingam, managing director, Equinomics Research & Advisory.

Adding: “I think over the next one year, oil marketing companies (OMCs) will emerge as a theme, as oil prices are likely to remain subdued. Despite automobile sales remaining subdued, fuel sales are showing no signs of slowing. Once auto sales also pick up, fuel sales will gather more momentum, which will benefit OMCs.”

Also Read: PSUs up investment ante, set to pump in 16% more in FY16

Domestic institutional investors were net buyers of Rs 27,259 crore during the quarter. They bought the majority of shares from FIIs.

Coal India That apart, FIIs, financial institutions, banks and insurance companies collectively sold equity shares aggregating Rs 1,312 crore in Coal India during Q2. Their holding at the end of September was 16.24 per cent, down from 16.77 per cent at the end of June.

“Coal India has underperformed the indices. We believe the sharp fall was not only due to change in investor sentiment but also due to a combination of concerns like overhang on the proposed stake dilution by the government and weakness seen in the e-auction segment,” says Kamlesh Bagmar of Prabhudas Lilladher in a recent report.

“We believe the stake dilution would remain an overhang in the immediate period, though we do not think the government would divest the stake at the current depressed valuations, especially when significant improvements are seen in the company’s operational performance and efforts are in place to achieve around 900 million tonnes offtake target in 2020. We upgrade our rating to 'buy' from ‘accumulate’, with a target price of Rs 405,” he adds.

)

)