After the Rs 25,000-crore fundraising plan by Vodafone India, Bharti Airtel, too, is shoring up its cash position to take on Reliance Jio and cut debt. India’s second largest telecom company by subscribers is raising up to Rs 32,000 crore, more than initially estimated, to bring down its debt levels and fund capital expenditure.

There are twin implications of the move. The first is of course equity dilution given that the fundraising includes Rs 25,000 crore of rights issue and Rs 7,000 crore of perpetual bonds with equity credit. Given the rights issue price of Rs 220, the offer will entail over 1.1 billion rights shares and translate into a post-issue dilution of 22 per cent.

Given that the offer price is at over 30 per cent discount to Thursday’s closing price, analysts at JM Financial believe there could be a price correction to the tune of 5 per cent in the near term. The discount, according to them, also reflects market uncertainty because of lack of visibility on telecom tariff hikes, geopolitical situation, upcoming general election and competition for public funds by rival Vodafone Idea. Bharti Airtel’s stock price was down over 3.4 per cent on Friday.

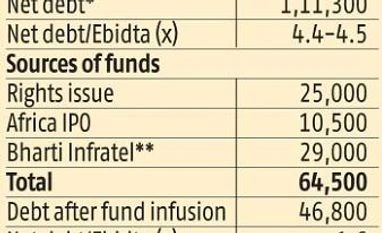

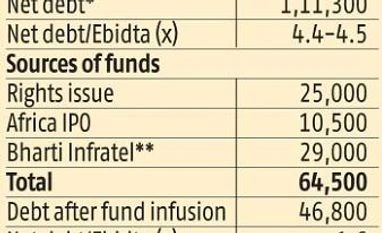

While near-term weakness was expected, the bigger implication would be on its debt. Bharti Airtel has a debt of Rs 1.13 trillion as of December 2018. This is 4.4-4.5 times its annualised operating profit. Given that there are few signs of competitive intensity coming down, bringing down debt is the only option. If the funds are used entirely to bring down debt, then leverage is expected to come down to 3.5 times by the end of FY19.

The equity raising is also important in the context of Moody’s Investor Services placing Bharti Airtel’s ratings on review for downgrade in November 2018, citing low levels of profitability and weak cash flow expectations.

In addition to falling interest costs, analysts believe that capital expenditure levels, too, are expected to come down as Bharti Airtel spent about Rs 75,000 crore over the last three years. Capex intensity is estimated to have peaked out and will reduce to Rs 20,000 crore over the next couple of years as compared to FY19 estimates of Rs 31,000 crore.

The higher-than-expected fundraise will also help the company participate in the 5G spectrum auction without stretching its leverage ratio beyond 3.5 times. Despite the significant dilution, analysts are positive on the company on account of deleveraging and expected uptick in average revenue per user. Analysts at Motilal Oswal say that paybacks from minimum recharge vouchers, a shift of feature phone to smartphones and tariff bottoming should help operating profits even at current pricing.

)

)