Gross sales of equity MFs likely to remain strong

Sector officials say interest is returning; MFs' net sales decline substantially in Feb

Chandan Kishore Kant Mumbai

India’s mutual fund sector seems to have been able to start attracting the long-awaited retail money into the stock markets. Already, during December-January, gross sales in the equity segment showed significant improvement. Sector executives anticipate the trend to continue on the back of rising interest among investors as the indices inch up.

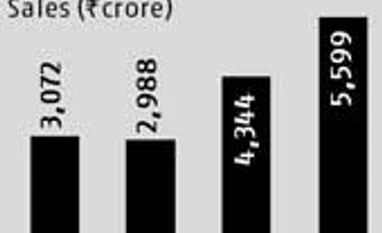

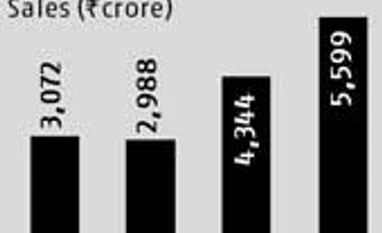

Against static monthly gross sales of around Rs 3,000 crore for the most part of the previous year, December witnessed fresh inflows to the tune of Rs 4,344 crore. In January it further rose to Rs 5,600 crore.

“Rise in gross equity sales is a positive indication for the industry,” says Srinivas Jain, chief marketing officer at SBI Mutual Fund. Sector officials say despite high redemption from the equity segment, inflow is on the rise over the last few months.

“I expect February would have continued the trend as well,” adds Akshay Gupta, chief executive officer and managing director of Peerless Mutual Fund. There have been general positive sentiments among investors arising out of the government’s announcements, which are helping them gain confidence about investments in the equity markets, he says.

During February, the broader equity markets traded weak. “There are investors who are making good use of weakness and entering the markets during such times,” said the national sales head of a private mutual fund house. According to him, if no major setback happens, growth in the economy will fuel further interest in equity markets.

According to Gupta, several measures taken to incentivise distributors have made financial advisors look at selling mutual funds as well.

Net selling by mutual fund houses dropped substantially in February. According to the statistics available from stock markets regulator Securities and Exchange Board of India (Sebi), net sales during February stood at Rs 847.9 crore. This is less than a sixth of that witnessed in January.

If reduction in net selling in February by fund houses is anything to go by, the month is likely to see decline in redemption from the equity segment - which could be positive for the sector as a whole. During April 2012 and January 2013, the fund industry saw net outflows of a massive Rs 15,000 crore - the highest so far in a year. In CY2012 alone, the sector lost 4.5 million equity folios.

Currently, Indian fund industry offers 343 equity-related schemes to investors. Of these, 294 are pure equity products, while the rest are equity-linked savings schemes.

)

)