Indian markets among slow starters this year

Domestically, last year's outliers IT and Pharma are once again emerging as the frontrunners

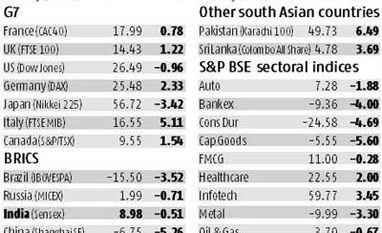

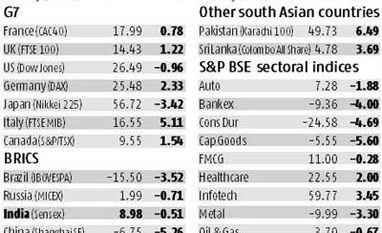

BS Reporter Mumbai With foreign investors making fresh allocations for 2014, it seems other South Asian markets are better placed than India. Among Brazil, Russia, India, China and South Africa (BRICS), Indian markets have seen a slow start, losing 0.5 per cent in the first two weeks of January.

Last year, Indian markets posted 8.9 per cent gains, after having slipped in the first few weeks.

South Africa’s JSE Africa Top 40 posted 1.7 per cent returns so far this year, owing to a strong domestic economy. The markets in Brazil, Russia and China have seen losses, with Brazil losing 3.5 per cent so far this year, Russia 0.7 per cent and China 5.2 per cent.

The markets in Sri Lanka and Pakistan are outpacing their Indian counterparts, posting returns of 6.5 and 3.7 per cent returns, respectively. Extrapolating these numbers, these countries could outperform India by a long margin. In 2013, the Karachi 100 index returned 49.4 per cent, while Sri Lanka’s Colombo All Share Index lost 4.7 per cent.

Globally, most equity markets started on a positive note—about four in five countries have gained so far this year. However, the Dow Jones and Japan’s Nikkei have seen drops of 0.367 per cent and 3.42 per cent, respectively.

In India, the situation is similar to last year, with the frontline information technology (IT) and healthcare indices posting gains. The BSE IT index is up 3.45 per cent, while BSE healthcare has seen a two per cent rise. As was the case last year, the IT and healthcare segments seem to be the investor’s favourites. In 2013, the BSE IT and healthcare indices gained 59.8 per cent and 22.6 per cent, respectively.

Investors, it seems, are ignoring all other major sectors. Going by the BSE’s performance so far this year, the power and realty indices are among the biggest losers (losses of 6.49 per cent and 7.45 per cent, respectively). These sectors were laggards in 2013, too.

Among the sectors that had fared well last year, fast-moving consumer goods (11 per cent returns) and automobiles (7.3 per cent) have started 2014 on a negative note, with losses of 0.28 per cent and 1.88 per cent, respectively. Analysts attribute this to a rise in valuations in these sectors.

)

)