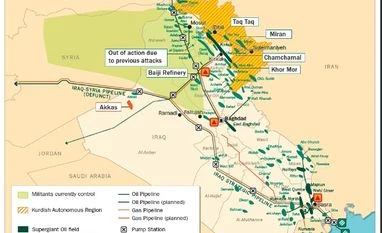

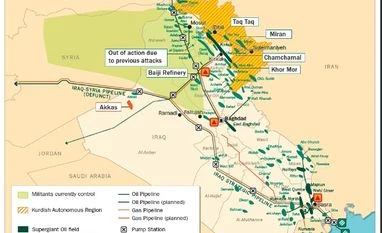

Iraq crisis: A primer on the impact on oil industry

Here's an encapsulation important oil and gas establishments in Iraq, key pipelines and their significance in the world oil market

Puneet Wadhwa New Delhi Although security forces insist they are now back in full control of the Baiji refinery, one of the biggest refineries in Iraq, after clashes with militants who held parts of the plant this week, the ongoing violence continues to impact oil markets. Brent crude oil prices hit the $115/barrel mark last week and continued to trend higher on Monday.

Here is an infographic (Map Source: Platts) on important oil and gas establishments in Iraq, key pipelines and their significance in the world oil market

* Iraq is now OPEC’s second largest producer behind Saudi Arabia. Output reached a high of 3.35 million barrels/day (b/d) in February 2014, according to a Platts survey, its highest in more than three decades, and accounting for about 3.6 per cent of global demand.

* The 320,000 b/d capacity Baiji plant, which produces nearly half of Iraq’s refined products including seven million litres/day of gasoline, remains shut

* Baiji plant also supplies gas feedstock for a northern gas processing plant, which has also been closed. This is likely to cause a shortfall of around 1,300 metric tonnes/day of LPG in addition to reducing gas feed to power stations around Baghdad, says Platts.

| Iraq is now OPEC’s second largest producer behind Saudi Arabia. Output reached a high of 3.35 million b/d in February 2014, according to a Platts survey, its highest in more than three decades, and accounting for about 3.6% of global demand. |

|

|

|

|

|

|

|

|

| MAJOR REFINERIES IN IRAQ | PRODUCTION * |

| BAIJI | 2,00,000 |

| BASRA | 1,26,000 |

| ERBIL | 40,000 |

| K3-HADITHA | 14,000 |

| KHANAQIN | 10,000 |

| MUFTHIA | 4,500 |

| QAIYARAH MOSUL | 4,000 |

| * In barrels per day (bpd) | |

| Source: Platts | |

* IMPACT ON INDIA: Iraqi crude supplies appear to be flowing normally from the Basrah Oil Terminal in the Persian Gulf from where India procures its oil. In June 2014, India is estimated to lift on an average of around 290,000 b/d

* The Indian government has asked the refiners to prepare short-and-medium term contingency plans and to diversify crude import sources to minimise the impact of any supply disruption from Iraq

)

)