Manpasand Beverages: Expensive offer

Flagship brand continues to do well but success of new launch 'Fruits Up' holds key

Sheetal AgarwalManpasand Beverages, based in Vadodara, Gujarat, manufactures fruit drinks. Mango-based drink Mango Sip is its flagship brand. The other key products of the company include apple juice (under ‘Sip’ brand), carbonated fruit drinks brand ‘Fruits Up’ (launched in a few cities in July 2014), Manpasand ORS and ‘Pure Sip’ bottled water. While ‘Mango Sip’ is focused largely on the rural and semi-urban markets, the company plans to launch the ‘Fruits Up’ range in large metros across the country.

The company is coming up with an initial public offering (IPO) to garner Rs 400 crore via fresh issue of shares. Of this, it plans to use Rs 192 crore for setting up a new manufacturing facility in Haryana (likely commissioning in January 2017) and modernisation of existing facilities in Vadodara and Varanasi, about Rs 100 crore towards repayment of debt (total at Rs 121 crore) and the rest for general corporate purposes. While the company will be almost debt-free after the issue leading to annual interest cost savings of Rs 7-8 crore besides a sizeable increase in capacity leading to strong growth, the offer is expensive apart from having business risks that cannot be over-looked.

Operationally, the Ebitda margin will be subject to the heightened brand and launch-related expenses (advertising, selling and promotion) towards ‘Fruits Up’. While the increased capacities will aid top-line (particularly for Mango Sip — 97 per cent of FY14 revenues), successful launch of ‘Fruits Up’ remains a monitorable given the high competitive intensity from heavyweights such as Pepsi, Coca- Cola, Dabur, ITC, among others.

Notably, the company had earlier failed with new launches such as Fons in the premium fruit juice category and Sip carbonated fruit drink. While ‘Mango Sip’ has a strong brand identity in the under-penetrated rural markets, the company's huge dependence on one product is a key risk. Manpasand competes with players such as Parle Agro (Frooti), Coca-Cola (Maaza) and Pepsi (Slice), which might affect its geographic expansion. The company plans a nationwide launch of ‘Fruits Up’ brand and believes it can contribute about 25 per cent to its FY16 revenues. It intends to set up an exclusive distribution network for ‘Fruits Up’ along with strengthening its existing network to all 29 states of India versus 24 states currently.

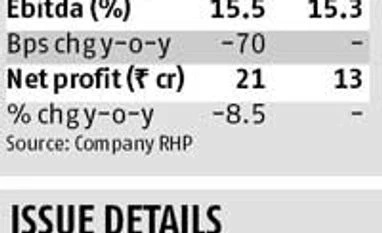

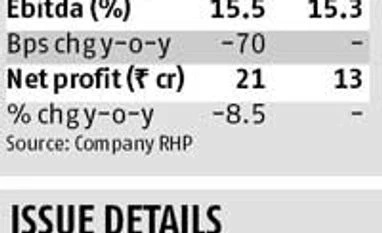

Valuations, too, are high. The company’s net profit fell by 8.5 per cent in FY14. Given that about 65 per cent of Manpasand's sales come between January and June, the first nine months’ figures look subdued. However, even after estimating a profit of Rs 30 crore in FY15 (which is optimistic) and assuming a 40 per cent growth in FY16 as well, at the price band of Rs 290-320, the IPO is valued at 35-38 times one-year forward price-to-earnings on a fully diluted equity base.

While there is no true comparable listed consumer goods player as Manpasand is a pure-play on juices, players such as Dabur (Real fruit juices) have a strong presence in the fruit juice segment. Dabur, the market leader in the juices segment, which is significantly large and well-diversified with strong brands in its portfolio, trades at 36.4 times its FY16 estimated earnings. This again suggests that Manpasand’s valuations are not cheap. Chitrangda Kapur of Reliance Securities believes Manpasand's return ratios stack up poorly to that of other listed foods companies such as Dabur and Britannia. While Manpasand's pre-issue return on equity (RoE) stands at 22 per cent, Dabur and Britannia enjoy relatively higher RoEs of 38.5 and 58 per cent, respectively, in FY14. Clearly, there are reasons for investors to skip this offer.

While single-product dependence and high competitive intensity are key risks, Manpasand might also witness the phasing out of tax benefits after FY20. Any delay in plans to expand capacities could also impact growth plans.

)

)