Small, mid-cap fund assets swell

AUM of these schemes up 32% in 3 months, a fifth of total equity AUM; returns exceed those of benchmarks

)

Explore Business Standard

Associate Sponsors

Co-sponsor

AUM of these schemes up 32% in 3 months, a fifth of total equity AUM; returns exceed those of benchmarks

)

Small-cap and mid-cap mutual fund (MF) schemes are making their presence felt on Dalal Street.

Piggybacking on the sharp rally seen in the shares of medium-size and small-size companies this year, assets under management (AUM) of these schemes have swelled nearly 40 per cent in the past year as against only a 5.4 per cent increase in overall equity assets.

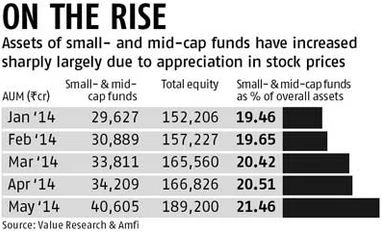

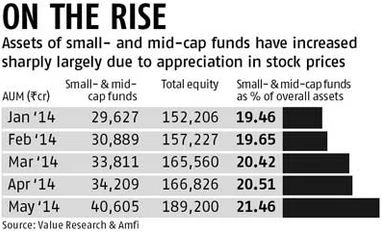

The bulk of these gains have come in the past three months. Since February, when the market started to rally, the AUM of mid- and small-cap funds have gone up nearly 32 per cent. The assets of these schemes stood at Rs 40,605 crore in May, compared to Rs 30,888 crore in February.

Sector officials said the AUM rise has been driven primarily by improving stock performance, rather than a jump in investment flows into these funds.

The Rs 10 lakh crore MF sector offers 57 unique mid-cap and small-cap funds, says Value Research, an entity tracking these. In the past three months, most of these schemes have delivered returns between 20 per cent and 60 per cent. The benchmark indices, the BSE Sensex and National Stock Exchange's Nifty, have gained about 15 per cent since February. While the BSE mid-cap index has gained about 30 per cent, the BSE small-cap index has gained close to 40 per cent.

“Returns in the mid-cap and small-cap category have been driven mainly by stock performance. Domestic investors of MFs had been on the redemption-side up until May, when the industry saw huge net inflows,” said S Krishna Kumar, head (equity), Sundaram MF.

According to data from the Association of Mutual Funds in India (Amfi), the sector saw monthly net inflows of Rs 200-500 crore between January and April. The exception was March, when there was a net outflow of Rs 2,102 crore.

Last month, however, net inflows were strong at Rs 2,452 crore, the highest monthly net inflow in a little more than three years.

Stock markets have been buoyant since the beginning of the year, on expectations that the economy is set for a turnaround under a new government, resulting in lower interest rates and a pick-up in the investment cycle. The rally hasn't been restricted to large-cap stocks; smaller companies have also seen a lot of action, with shares of many companies gaining multi-fold.

“A large number of mid- and small-cap stocks look promising because they are relatively cheaper than some of the large-cap names. As more and more domestic investors return to the market, the outlook for these funds looks promising,” said Dhirendra Kumar, chief executive of Value Research.

While mid-cap and small-cap names across sectors have been surging, fund managers said those in the automobile, cement, capital goods and industrial sectors are expected to see further upsides.

The AUM under the mid-cap and small-cap funds now account for a little more than a fifth of the total equity AUM of Rs 1.89 lakh crore as of May.

Wealth managers believe investors should consider small-cap oriented MF schemes to play the rally in these counters. “Retail investors should choose the MF route while taking exposure to the mid- and small-cap category, rather than speculate on individual stocks. In a portfolio of stocks like in the case of MFs, there will always be elements which act as a hedge and help limit the downside risks,” said Raghavendra Nath, managing director, Ladderup Corporate Advisory.

First Published: Jun 17 2014 | 10:50 PM IST