RIL, RCom, MMTC among biggest wealth destroyers in '08-13

Investors in the petroleum major have seen wealth erosion of Rs 1.13 lakh cr, says Motilal Oswal Annual Wealth Creation Study

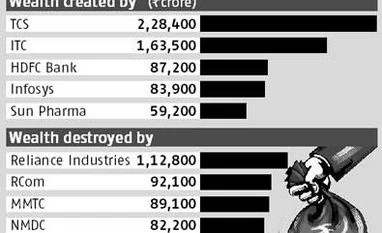

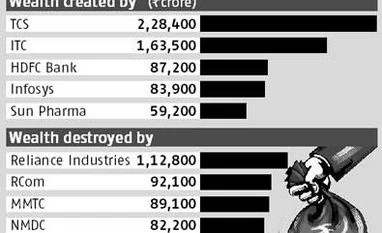

BS Reporter Mumbai Reliance Industries Ltd (RIL) was the largest destroyer of investor wealth between 2008 and 2013. During this period, investors in the petroleum major saw wealth erosion of Rs 1.13 lakh crore, according to the Motilal Oswal Annual Wealth Creation Study.

The report said a third of the wealth wiped out during this period could be attributed to three major ownership groups - those of the two Ambani brothers, as well as the government of India. The top ten list of wealth destroyers includes RIL, Reliance Communications, MMTC, NMDC, DLF, Reliance Power and BHEL.

TCS emerged the biggest wealth creator for the 2008-2013 period. The technology major added Rs 2.28 lakh crore to investor wealth during this period. TTK Prestige emerged the fastest wealth creator, with a stock price that multiplied 28 times in five years, or annualised returns of 95 per cent. The most consistent wealth creator was Asian Paints.

"The stock market's perception of ineffective management (including capital mis-allocation, consistent failure to deliver on guidance and low dividend payout) is a major source of wealth destruction. When the market is disappointed, it does not spare even those stocks that were its darlings till recently," said the report, authored by Raamdeo Agrawal and Shrinath Mithanthaya.

The report added the consumption story in the retail sector, which emerged the largest wealth-creating sector for the first time since 1999, may well have played out.

"The technology sector is poised to emerge as India's largest wealth creator in the near future (already, TCS has the highest market-cap among Indian companies). The current leader, consumer, enjoys average P/E (price/earnings) multiples of 33x, which is about 2x the market average of 15x. This leaves little room for further re-rating. In contrast, the technology sector is valued at 19x, which is reasonable, considering its high PAT CAGR (compounded annual growth in profit after tax) coupled with higher-than-average RoE (return on equity)," said the report. The study painted a positive outlook for markets. It said corporate earnings growth was starting to look up and valuations seemed on the way to seeing an upside.

)

)