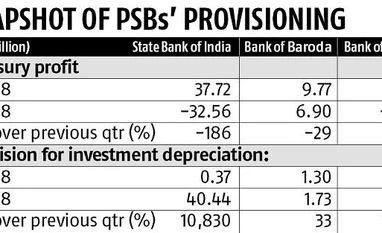

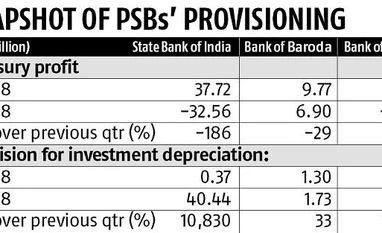

Rajnish Kumar, chairman of India’s largest lender State Bank of India (SBI), in an interview with a news channel, said the rise in government bond yields might affect the bank’s March quarter (Q4) results and the mark-to-market provisions would hit most banks. So, there is little doubt that other public sector banks (PSBs) will not go unscathed.

As witnessed in the December quarter, the increase in 10-year government bond (G-secs) yield will continue to worsen the provisioning pain for most PSBs in Q4, thereby weighing on their earnings.

Though notional in nature — as these are book losses until the security is actually sold — banks are required to provide for the mark-to-market losses incurred due to lower market value of treasury instruments held in the available for sale (AFS) segment — compared to their value at the end of the previous quarter — on a quarterly basis.

Since September 2017, G-sec yields have been rising fast, leading to high mark-to-market provisioning for treasury losses for most banks. According to Icra, “Factors such as elevated inflation, caution on the fiscal outlook, concerns over demand for government bonds from banks and foreign portfolio investors (FPIs), low likelihood of open market operations (OMOs) by the Reserve Bank of India (RBI), and rising global yields are expected to keep Indian bond yields elevated in the near term.”

In absolute terms, the 10-year G-sec yield increased 67 basis points (bps) to 7.33 per cent as on December 31. Since then, the yield had risen to 7.69 per cent, by 36 bps, on February 26. Analysts said if yields remained elevated, PSBs would face additional provisioning in Q4 as well.

PSBs will be affected more than private players as the former majorly invest in government bonds. In absence of credit growth, PSBs tend to keep excess deposits in government bonds, prices of which are inversely related to yields. “If yields stay at the current level then the banking sector could face a further mark-to-market loss of around Rs 100 billion in Q4. Of this, a significant portion (over 75 per cent) will be on account of PSBs,” says Karthik Srinivasan, group head-financial sectors rating, at Icra.

The RBI’s new non-performing asset resolution framework is also likely to exacerbate the provisioning pain of banks, ultimately affecting their profits. Consequently, bank stocks are likely to remain under pressure in the near term.

)

)