Success of Search Plus key for Just Dial

Continued investments in new launches will keep margins under check in the near term, even as the basic search business continues to do well

Sheetal Agarwal Mumbai The Just Dial scrip has under-performed the S&P BSE Sensex over the past year and trades about 25 per cent below its 52-week (and all-time) high of Rs 1,895, made in August last year.

Continued investment in its Search Plus platform, future new product launches such as Just Cash, Just Dial Guaranteed and high advertising costs (leading to margin pressure) are some reasons. A muted trend in other income and a higher tax rate has also impacted net profit growth. The stock’s strong rally since listing (June 5, 2013) till February 2014, of 136 per cent, can also be partly attributed to the correction in the past year.

Going forward, successful launch and monetisation of its Search Plus platform will be a key catalyst, believe analysts. This platform will combine Just Dial’s search services with transaction-based ones such as online food delivery, groceries, wine delivery, doctors’ appointments, taxi bookings and online purchases of electronics, among others. The company plans to launch Search Plus in the first quarter of FY16 and expects its monetisation to start in the second half.

As the gains are a few quarters away and the company might have to incur higher advertising spending in the interim. So, analysts are not ruling out consolidation or underperformance for the scrip in the near term.

“Given that Just Dial is entering an investment phase, we believe the stock might consolidate in the near term. We downgrade our EPS (earnings per share) estimates by four per cent and 29 per cent for FY15 and FY16, respectively, to build in lower other income and higher advertising spend,” say analysts at Motilal Oswal Securities, who maintain a 'Buy' rating on the stock, with a target price of Rs 1,800.

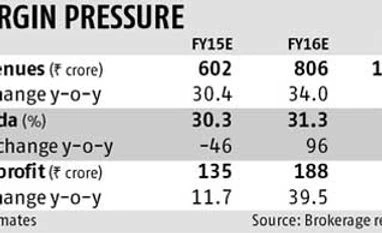

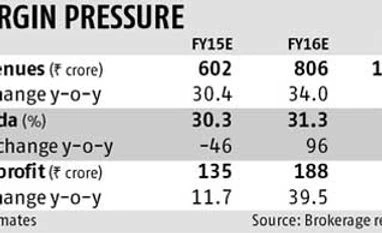

The Ebitda (earnings before interest, taxes, depreciation and amortisation) margins, which had fallen sharply to 25 per cent levels, have risen back to 30-plus per cent. While the margins could see some pressure in the near term, some margin recovery is expected in FY16. The larger gains are expected in FY17, when this metric is estimated to increase by a huge 445 basis points to 35.8 per cent as Search Plus starts contributing meaningfully to the revenues and as ad spends start coming down, believe analysts.

Meanwhile, Just Dial’s basic business of voice and internet search, which accounts for most of its revenues and profits, continues to do well and will provide support to valuations. Revenues have grown at a healthy 28-30 per cent in the past few quarters, on the back of continued momentum in paid campaigns. Just Dial’s paid campaigns have grown by 24-27 per cent on a year-on-year basis over the past six to seven quarters and will be a key growth driver.

Paid campaigns currently account for only two per cent of total listings and, hence, there is a lot of room to scale up. Analysts believe its growth will sustain at 25-26 per cent annually over the next two years. Search Plus is expected to contribute revenue of Rs 50-70 crore in FY17 and ramp up further in consequent years.

Just Dial is a play on India’s fast growing e-commerce space and, given its strong brand and leadership position in local searches, is well poised to benefit from the increasing demand for online services. Just Dial also plans to monetise its large listings base and focus on making these go online. Additionally, the company is stepping up its presence in local search in Britain, America and West Asia.

Not surprisingly, most analysts (polled by Bloomberg in 2015 so far) remain bullish on Just Dial. They believe investors can use the current weakness to buy the stock. Their average target price is Rs 1,727 and indicates upside potential of about 23 per cent from current levels.

)

)