Tata Sons’ announcement to replace chairman Cyrus Mistry with Ratan Tata came as a surprise to the investing community. The move, which came after the end of Monday’s trading session, could put stocks such as Tata Steel, Tata Chemicals and Tata Motors in the spotlight on Tuesday.

“Tata group is not known to spring such surprises. This being the first of its kind, could result in some knee-jerk trades in the first half of Tuesday’s session,” said the CEO of a domestic brokerage, who did not wish to be named.

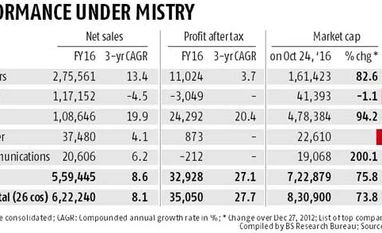

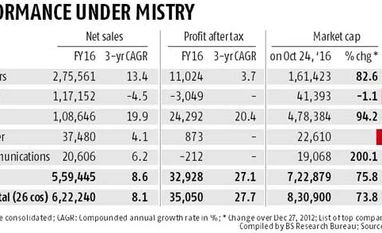

An analysis of the Tata group stocks indicates that about 60 per cent of the group’s stocks have outperformed the BSE Sensex stock performance ever since Mistry took charge. TCS, Tata Motors, Tata Chemicals and Trent have delivered 13–19 per cent compounded annual growth rate (CAGR) returns since December 27, 2012 till date, while the Sensex has returned 10 per cent gains during this period. Some smaller stocks, such as Tata Metaliks, Tata Elxsi, Voltas, and Tata Communications have zoomed by 33–66 per cent CAGR since Mistry assumed office.

(REVERSING DECISIONS THROUGH SELL-OFFS IN TATA GROUP) The trouble is with Tata Power, Tata Tele (Maharashtra), and Tata Global Beverages, which have ceded 1–8 per cent of their market capitalisation, while Tata Steel’s stock hasn’t moved much in this period. However, investors need to remember that efforts are on by the Tata group to exit from some non-profitable businesses, particularly in the overseas markets.

“The Tata group is in the process of hiving off some cash-guzzling businesses whether in steel or chemicals businesses. Cyrus Mistry has been spearheading these developments, but with Ratan Tata in the driver’s seat now, the decisions could change. This is negative for Tata Steel, Tata Chemicals and Tata Global Beverages,” added the brokerage CEO cited above.

However, Deven Choksey, managing director of KR Choksey Investment Managers, prefers to wait for more details. “Tata group stocks may not go one-way down in tomorrow’s (Tuesday’s) trade. The market will wait for more clarity before they can react strongly to this development,” he added, while warning that Monday’s development indicated that all is not well for the Group.

U R Bhat, managing director of Dalton Capital Advisors, agrees with Choksey. “Ratan Tata taking charge may be seen as a positive as he has been regarded as a market favourite. Also, he will take charge only for four months. I don’t think he will make dramatic changes during this tenure.”

However, other experts said if his tenure exceeds four months, and if there is no clarity on the reasons for a sudden change of power within the Tata group, investors might have to brace for some major reversal of trends in Tata group stocks.

)

)