Weekly: Markets retreat from record highs amid valuation concerns

Slowdown in Q2 GDP growth and RBI's decision to hold key policy rates also dampened sentiment

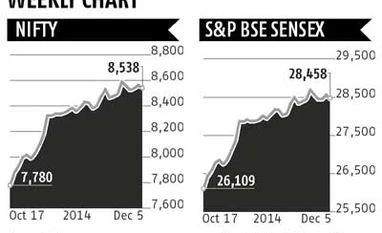

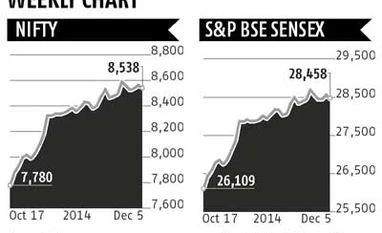

Jinsy Mathew Mumbai Benchmark indices snapped a six-week winning streak to end lower in the week to December 5, as investors turned cautious and booked profits on valuation concerns and not-so-steady global economies.

Locally, the slowdown in economic growth in the second quarter along with the Reserve Bank of India (RBI) maintaining status quo in its policy meeting this week dampened investor sentiment. The only silver lining was RBI Governor Raghuram Rajan’s comment that rates could ease early next year, as inflation is showing signs of cooling.

For the quarter ended September, India’s gross domestic product (GDP) grew 5.3 per cent, compared with 5.7 per cent in the previous quarter. The fall was primarily due to slow growth in the manufacturing sector, which expanded only 0.1 per cent, compared with 3.5 per cent in the previous quarter.

RBI recently kept interest rates unchanged at 8 per cent as widely expected, staying focused on containing inflation, while adopting a more dovish tone in response to the government's call for help to revive economic growth. For the week, the Sensex declined 236 points or 0.8 per cent at 28,458 and the Nifty closed 50 points or 0.6 per cent lower at 8,538.

However, the broader markets were a picture of strength with investor interest intact. The BSE Small-cap Index advanced 1.8 per cent and the BSE Mid-cap Index gained 2.2 per cent over the last five trading sessions.

Gains in ITC, HUL and Godrej Consumer up 4-8 per cent helped the FMCG index emerge as the top sectoral gainer with gains of over 5.5 per cent. ITC gained through the week as media reports suggested that the government was reconsidering a proposal to ban sale of loose cigarettes.

Even though RBI decided to stay put on interest rates, rate sensitive pockets like Realty, Bankex and Auto indices, gained 0.7-1.8 per cent, and were among the other top sectoral gainers of the week.

Among the laggards were oil & gas, IT, power, PSU and metal indices down 0.6-3.2 per cent. From the auto pack, Maruti Suzuki, Hero MotoCorp and Eicher Motor were the top gainers up 1-5 per cent. Meanwhile, Bajaj Auto, Tata Motors and Mahindra & Mahindra declined up to 2 per cent post reporting weak sales numbers for the month of November. Sesa Sterlite, Axis Bank, ICICI Bank, Cipla and Coal India up 0.5-4.5 per cent were the only other names in green among Sensex-30.

Oil and gas was another weak space with RIL, ONGC and GAIL down 3-4 per cent.

Hindalco, Dr Reddy's, Tata Power, BHEL, HDFC, Bharti Airtel down 4-6 per cent were some the other notable losers.

Week ahead

The government will release inflation data based on the Whole-sale Price Index on Monday, December 8.

On Friday, the government will release inflation data base on the Consumer Price Index and Index of Industrial Production for October 2014.

Further, stock-specific action will be seen depending on the policy announcements at the winter session of Parliament. IT stocks are likely to firm up because of better-than-expected US jobs data, which showed that non-farm payrolls in November jumped by 321,000, the highest in any month since January 2012.

)

)