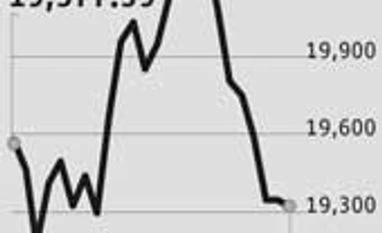

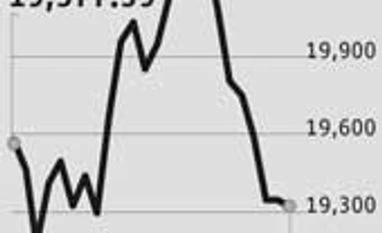

RBI's monetary activism may take a toll on equities, too

Earnings downgrades start as Street doesn't expect tightening measures to be reversed in a hurry

Malini Bhupta Mumbai Equity market strategists have given their verdict on India, after a spate of measures announced by the Reserve Bank of India (RBI) to stem the rupee's fall. They believe India has little going for itself at the moment and the 'radical' measures unleashed by the central bank won't be rolled back in a hurry. As Jefferies, a foreign brokerage firm, put it: "The currency line in sand would likely be tested multiple times." Fears of unexpected monetary activism by RBI would keep markets nervous. Both the currency's fall and RBI's subsequent measures to curb it are expected to wreak havoc for corporate India. A faltering currency will not only push up costs for corporate, but will also erode profits as forex translation losses and interest payouts will rise.

Consequently, a lot has been downgraded over the past few days. Aditya Narain of Citi Research says: "Consensus earnings revisions data suggest India is downgrading relatively sharply and faster than others… in sync with its historically higher volatility." After downgrades in GDP estimates, earnings estimates are now heading south. Earnings growth is expected to slow to five per cent in the current financial year. Real demand is negative and economic growth is likely to be lower than estimates. RBI's recent liquidity squeeze will drag economic growth down by at least one per cent. Goldman Sachs expects earnings to grow at five per cent in FY14 and 11 per cent in FY15, below consensus expectations, with sales growth to moderate further and margins to remain under pressure.

What is worrying is that demand, measured through sales growth (ex-financials and energy), is growing at a slower pace than inflation in India currently. In an environment where real growth is negative, companies would have little headroom to pass on any increase in costs, which would put pressure on margins. The outlook has turned bearish as there are few places to hide at the moment. Defensives are back in focus as staples and technology continue to report double-digit growth, even as others are reporting muted performance. Financials have been downgraded by most analysts as they believe "monetary activism" will hinder the sector's growth and profitability.

What's worse is that few in the market believe that RBI will roll back its tightening measures in a calibrated way. Even if the government announces trade and investment measures, the balance of payments situation is unlikely to improve over the next 12 months. Equity analysts at Jefferies believe it is more likely than not that "currency volatility will return with every unforeseen event in domestic politics, economy or global financial markets in the next 12 months to come".

)

)