Street looking forward to better days for Coal India

Firm in positive light after price hikes, volume growth, buyback news

Ujjval Jauhari New Delhi Positive news on Coal India continues. After price hikes in end-May, the company achieved 99 per cent production target in June. The latest is the board's meeting on July 11 to consider buyback of shares.

Buyback news is positive as the stock was under pressure on concerns of government selling its stake. Instead of increasing the supply of shares (through stake sale), buyback will reduce it, boosting share.

Jefferies points out a possibility of a buyback worth Rs 3,600-4,800 crore and uptick in earnings per share. They believe markets could view a reasonably sized buyback positively, and it reduces the risk of excess cash in low-return non-core projects.

A foreign brokerage says the buyback will be at a premium. It views higher volumes with Ujwal Discom Assurance Yojana, forward e-auctions, cutting of coal prices (based on quality) and price hikes, positively.

Buyback apart, price hikes directed towards coal supplied under fuel supply agreements to power producers after three years were fairly balanced. While higher-grade coal prices were adjusted downwards, prices of rest went up in a way that blended per tonne realisations improved Rs 60-75, say analysts. The hike is expected to add Rs 3,200 crore to revenue in FY17.

Data suggest the firm is doing well, given coal production of 42.72 million tonnes (mt) and dispatches of 44.96 mt for June. Given the quarterly trend, analysts expect FY16 growth of nine per cent to sustain in FY17. Siddharth Oberoi, analyst at Prudent Equity, says, for the first time in decades, production in India is growing nine per cent on a consistent basis.

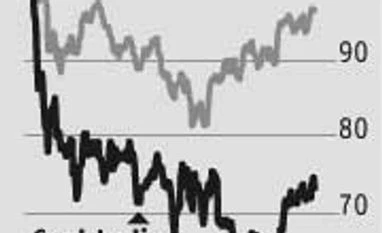

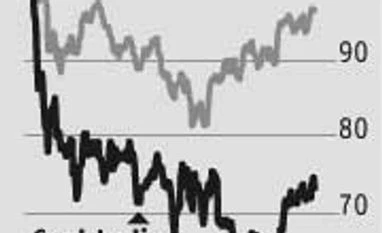

Analysts at Nomura expect coal production growth to be higher versus the June quarter on robust electricity demand over the past few months, moderating coal inventory at power stations, and cut in prices for high-grade coal. Following the positive news, the stock has recovered from February lows of Rs 272 to Rs 315, and could gain more. While consensus target price is Rs 365, Credit Suisse has assumed coverage of Coal India with outperform rating and target price of Rs 400 on local demand, high dividend yield, healthy free cash flows, and buyback.

)

)