Ashok Leyland: Early signs of slowdown?

After a strong FY16, the single-digit volume growth for two months could pressure the stock

Ram Prasad Sahu Mumbai The month of May, unlike earlier, now seems to be more than a blip. After growing eight per cent in May, medium and heavy commercial vehicle (M&HCV) sales volumes grew in single-digit for the second consecutive month; June volumes were also up seven per cent. This is in sharp contrast to the average growth of 30 per cent in the prior six months.

While the jury is out on whether the volume pressure is of short-term nature, the Ashok Leyland scrip is down about a per cent over two days versus a per cent rise in the Sensex.

Some reasons for the slowdown are likely advance purchases over the past few months on expectations of price increases by auto companies and transaction tax in June. Elections in south in May, which led to the slowdown in grant of new permits, had also impacted the company’s sales. Analysts at Kotak Institutional Equities say these are early signs of a slowdown. M&HCV industry volumes, which grew four per cent year-on-year in June, could come off significantly if replacement demand weakens going ahead, they add.

While the rate of growth is expected to come down, there are some triggers for the sector and the company. Analysts at Sharekhan, who expect the sector to grow at 15 per cent of FY16-18, say a pick-up in road construction and mining sectors, improvement in rural demand due to normal monsoons and traction in overall manufacturing activity are expected to drive double-digit growth in M&HCV volumes. Deutsche Bank analysts, who have forecast FY17 sector growth of 30 per cent (June quarter growth is only at 14 per cent), expect a stronger second half in the current financial year on the back of emission norms (BS-IV)-related pre-buying.

The other trigger could be value-unlocking after listing of its subsidiary Hinduja Leyland Finance. Ashok Leyland has a 57.4 per cent stake in this vehicle finance company, which ended FY16 with a net profit of Rs 150 crore.

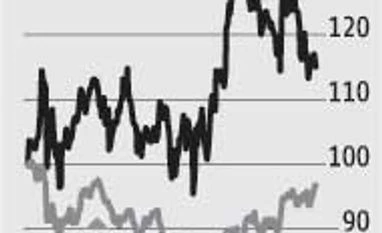

While volume growth has slowed, some analysts say the stock (down 10 per cent since early June) offers an attractive entry point. Higher operating leverage is expected to improve margins (11.5 per cent in FY16) offsetting some of the pressures due to the recent rise in commodity prices.

Ashok Leyland is trading at 18 times its FY17 estimates with about 60 per cent of analysts having a 'buy'. Consensus target price, Rs 110; upside of 13 per cent. While there are long-term triggers, investors should await better entry points to improve the potential.

)

)