Strong show ahead for Oberoi Realty

Good response to Borivali project and ongoing sales in other projects keep cash flows healthy

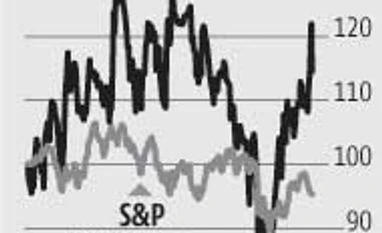

Ram Prasad Sahu Mumbai The Oberoi scrip shed 4.5 per cent, as its September quarter numbers came in below expectations. Revenues were up only two per cent year-on-year to Rs 187 crore, missing estimates by 17 per cent due to lower sales from existing inventory. Sales in a seasonally weak quarter came in largely from its completed project — Exquisite in Goregaon, Mumbai.

Sales from other projects saw a marginal increase. While cumulative collections in Exquisite are at 96 per cent, its other projects in Goregaon (Esquire), Juhu and Mulund are between 20 and 56 per cent. The situation is expected to improve in the December quarter.

Cash flows were strong in the quarter both on account of collections (Rs 260 crore) as well as proceeds from equity issue (Rs 330 crore). Analysts say the net debt post the cash inflow is nil. What caught the Street’s attention has been the response to the company’s launch of its Borivali project in Mumbai suburbs called Sky City.

The firm’s first big launch in three years in the western suburbs saw a good response given that 543 of the 800 units on offer were sold for a cumulative value of Rs 1,350 crore, translating to a base price (for carpet area) of Rs 22,500 per square foot. The strong sales of units priced at Rs 2.3 crore apiece within three days of launch is a stark contrast to developers who are sitting on high inventory and fewer sales in a sluggish market.

The sale of the first phase of the 25-acre Sky City project means the company’s year-to-date sales are five times higher than that of CY14. IIFL analysts say this reflects the Oberoi brand’s strength in a market where many developers are struggling to sell completed projects. The stock rose six per cent on Monday on news of the sales, but it tanked as muted September quarter numbers came in.

Going ahead, the Street will eye progress at its Worli project called Three Sixty West, which it will co-brand with Ritz Carlton. The company has so far invested Rs 1,200 crore in working capital and sales in the project will help free up cash flows.

IIFL analysts expect annual growth in the company’s earnings before depreciation, interest and amortisation to grow at 70 per cent over the FY15-17 period as its pre-sold projects enter revenue recognition stage.

Given the pre-sales, collections and pipeline, most analysts continue to have a ‘buy’ rating on the stock.

)

)