Will the corporate governance structure change?

Stringent rules for independent directors in state-run banks and insurance companies

Deepak PatelWith the government notifying new rules for the appointment of independent directors (IDs) for public sector banks (PSBs), public sector insurance companies, Reserve Bank of India (RBI) and financial institutions (FIs), it has become clear that the government wants to alter the level of corporate governance practised in these boardrooms. However, many experts familiar with the functioning of these companies' boards feel that it might not be enough to change the status quo and more needs to be done to change the governance structure in the boardrooms.

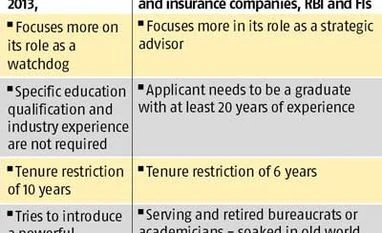

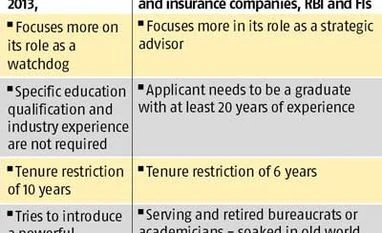

So what has changed? While the Companies Act, 2013, which was implemented last year, was one step forward to give IDs more power, they were much more broadly defined - focusing more on the duty on the ID to ensure that the interest of all stakeholders are protected; particularly minority shareholders.

According to Companies Act, 2013, an ID should be a person who, in the opinion of the Board, is a person of integrity and possesses relevant expertise and experience. Further, he/she should also possess 'appropriate skills, experience and knowledge' in one or more fields of finance, law, management, sales etc.

On the other hand, the rules recently notified for PSB, FIs, RBI and insurance companies have a much more focused tone - giving them a tenure of six years, asking for a minimum 20 years of experience from persons coming from industry, putting an age restriction at 67 years.

Moreover, the government officials who have 20 years of experience with 10 years at joint secretary or above; retired chief managing directors/executive directors of PSBs after one year of cooling period; academicians, chartered accountants and professors with more than 20 years experience ; will be the only eligible ones to apply.

"The normal expectation globally of the role of an Independent Director is essentially two-fold: advisory and monitoring," said an expert who did not wish to be named.

"While the Companies Act focuses more on the 'monitoring' part - asking ID to ensure the interest of all stakeholders; particularly minority shareholders; the rules for ID appointment in state-run banks and insurance companies envisage him/her more as a 'strategic advisor," the expert added. " For example, one of the acceptable qualifications of an independent director is that he or she led a reputed organisation or brought turnaround in a failing organisation."

What do experts fear?

The qualification rules focuses more on how the 'government officers' can apply. This tilts the scale more towards the role of IDs as a strategic advisor. The experts are worried that the seasoned bureaucrats will find these positions more attractive for post-retirement stationing, affecting governance of the board room.

"Given the unique nature of banks, financial institutions and insurance companies, it is appropriate to prescribe more detailed and specific education and other requirements. There is nothing wrong in that," said Dolphy D'Souza, Partner at a member firm of Ernst & Young Global. "However, the emphasis should have been to get more people from the private sector as independent directors in PSBs, FIs, RBI and insurance companies rather than retired bureaucrats. This is important to delink the public sector from the hold of the political class and bureaucracy."

It is a known fact there is a lack of qualified IDs - who have a certain industry experience - even in the private sector. Moreover, there are more lucrative offers waiting for them in other private sector companies, which have to mandatorily appoint one-third of their board as IDs, as per the new Companies Act.

"Such IDs do not have an incentive to enter the boards of state-run banks and insurance companies," said another Mumbai-based expert. "Moreover, the state-run banks etc. are yet to culturally evolve in this corporate governance structure to a point where they have strong IDs who can speak their minds."

"The only concern could be that these positions at PSUs should not be parking place for the retired senior officials, as there is a need of strong corporate governance mechanism with PSUs," said Harinderjit Singh, partner - Price Waterhouse.

Many PSUs are right now looking for IDs to fill up the vacant positions. Therefore, the only way to know if the government really wants a corporate governance improvement in PSB, FIs, RBI and insurance companies, is when the appointments begin.

)

)