DHFL NCD suitable for those in lower tax bracket

Inflation-linked option offers no added benefit as underlying benchmark is difficult to predict

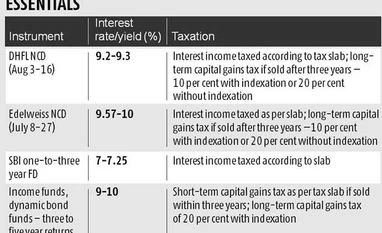

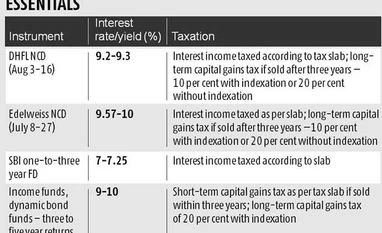

Priya Nair The season of non-convertible debentures (NCD) is on. In the next couple of days, Dewan Housing Finance Corporation (DHFL) will launch its NCD offering with attractive rates of 9.2- 9.3 per cent to retail and high net worth individuals. The tenors are three, five and 10 years, with monthly, annual and cumulative interest payment options. The issue has a rating of ‘AAA’ from CARE and Brickwork. Last month, Edelweiss Housing Finance’s NCD offered yields of 9.5 -10 per cent for tenors ranging from three to 10 years.

However, investment experts are not so enthused. With falling fixed deposit rates, some exposure to NCDs can help, says Amit Kukreja, founder, WealthBeing Advisors. “The yield is attractive, as it is 1.5-2 per cent higher than bank fixed deposits (State Bank of India offers 7-7.25 per cent on one to three-year FDs). The rating is also high. But, investors must keep in mind that the company has high exposure to the home loan sector,’’ he says.

Kukreja advises the cumulative interest payment option and investing for more than three years, then you as can get long-term capital while selling.

According to Feroze Azeez, deputy chief executive, Anand Rathi Private Wealth Management, investment in a debt mutual fund can give higher returns and will be more tax-efficient than NCDs. “If you opt for a Systematic Withdrawal Plan in a good debt MF, it will meet your requirement of regular fixed returns. An NCD is not tax efficient for those in the 20-30 per cent tax bracket, as the interest is taxed on your income slab. Capital appreciation is difficult in an NCD, as it will be difficult to sell,’’ he says. Currently, three to five-year returns from dynamic bond and income funds are in the range of 9-10 per cent, similar to the offer by DHFL.

DHFL is also offering a three-year Consumer Price Index (CPI) linked floating interest rate option. Here, the coupon rate for retail and HNI investors is currently 9.2 per cent (CPI+4.18 per cent) and the coupon rate for institutional investors is currently 9.1 per cent (CPI+4.08 per cent). The CPI reference rate currently is 5.02 per cent, which is the 12-month average for the period before the record date. The floor rate on interest rate for all categories is 8.9 per cent and cap is 9.5 per cent. The latest CPI for June was 5.77 per cent.

Experts are also not too enthused by the CPI linked option because the upside is limited and difficult to predict. “The upside is limited because we are headed towards lower interest rate scenario and the benchmark will be lower going ahead,’’ says Tanwr Alam, Founder and CEO, Fincart. For those looking for secure returns, Public Provident Fund or National Savings Certificates are a better option and also offer tax benefits, he adds.

“Even if inflation is going down, food inflation contributes as much as 40 per cent and that dependent on monsoon. So, the coupon will be benchmarked to a data that could be volatile,’ ’ points out Azeez. The CPI-linked option may appeal only to those who have a total contrary view of inflation and interest rates.

The coupon for the CPI-linked option will change once a year on the record date, says Harshil Mehta, CEO, DHFL. “We are offering this as an additional option for retail investors. The aim is to de-risk your investment if there is a huge fluctuation in the next few years,’’ he says.

)

)