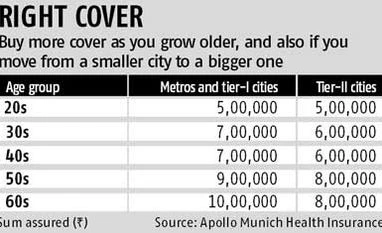

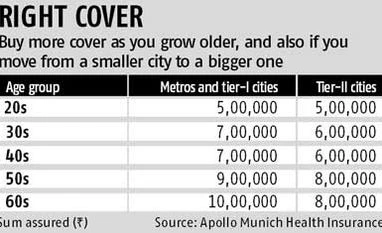

If you own a personal health insurance cover, you need to check from time to time whether its sum insured is adequate. When you do so, you may well discover that you are grossly under-insured for your current needs. A recent survey by Apollo Munich Health Insurance, which covered 700,000 people across 82 cities, found that 51 per cent of those who own a cover are under-insured. Another key finding of the survey was that 63 per cent of those in the above-45 age bracket - people who are more likely to need health insurance - are under-insured.

One cause for under-insurance is lack of awareness. “People may have bought a cover worth Rs 2-3 lakh many years ago. It may have been adequate then but will not suffice now, more so if they lived in a smaller city then but have now moved to a metro, where medical expenses tend to be higher,” says Antony Jacob, chief executive officer, Apollo Munich Health Insurance.

The insured also need to take into account the high rate of medical inflation in India. “Factor in a medical inflation rate of 15-20 per cent when deciding on your cover,” says Kapil Mehta, co-founder and managing director, Secure Now Insurance Broker.

)

)