Are you looking for regular income from mutual funds? If so, the question is what is the best way to invest in mutual funds to get a steady flow of money from them. In calendar year 2017, investors had lapped up monthly dividend paying hybrid mutual fund schemes as booming markets and higher dividend income compared to traditional fixed deposits had made them a good source of regular income. However, investment experts feel this may not be the best means to earn a regular income from funds.

For the uninitiated, mutual funds pay dividends out of the profits the scheme has made by selling a portion of its investments. The net asset value of the mutual fund scheme falls to the extent of the dividend paid. This simply means if you do not choose to receive dividends, your entire money (net asset) remains invested in the scheme.

Quantum and timing not assured: Since a scheme can only pay dividends out of the profits it makes by selling its investments, the timing and quantum of dividend are not assured. Though there are many schemes that offer to pay a monthly dividend, the frequency is not guaranteed. The quantum of dividend also depends on the profits the scheme makes. “Dividends can fluctuate, especially for equity mutual funds. Since hybrid and bond funds have a fixed-income component, they have a better possibility of generating cash on the portfolio to pay out regular and consistent dividends. However, it is not necessary that dividends would be paid. It all depends on the cash surplus a scheme is able to generate. Though equity mutual funds are volatile in the short run, in the long run they tend to pay annual dividends more often than not,” says Abhinav Angirish, founder, InvestOnline.in. In the case of schemes investing in equities, the quantum of dividend may be more volatile. Though investors may pocket higher dividends in bull phases, these schemes may not pay any dividend in bearish times. This has been proved in the past also.

Monthly Income Plans, which were popular during the structural bull run that ended with the global financial crisis of 2008, skipped dividends for many months in a row. If the stock markets remain volatile then it becomes difficult for the fund manager to announce dividends consistently.

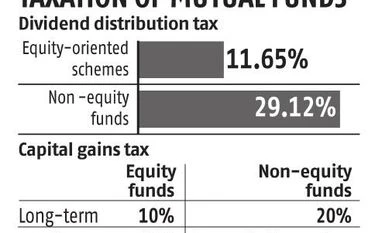

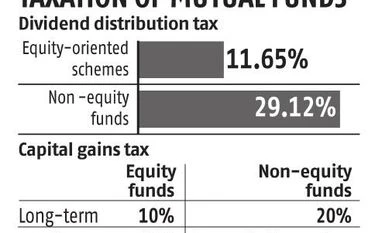

The tax factor: Another factor that goes against dividend receipts from mutual funds is the Dividend Distribution Tax (DDT) they attract. For many years, debt mutual funds have been subject to dividend distribution tax (DDT) of 29.12 per cent. This has made dividends from debt funds unattractive for most investors. Dividends declared by equity mutual funds, however, were tax-free till last year. However, since April 1, 2018, equity mutual funds have also been brought under the purview of DDT at the rate of 10 per cent. This has made dividends from equity funds less attractive. An equity fund, for the purpose of taxation, is a scheme that invests at least 65 per cent of its money in equity and equity-related instruments listed on Indian stock exchanges.

SWP may be a better option: But does that mean mutual funds can’t offer you regular income? You just have to think beyond dividend option. Instead opt for a systematic withdrawal plan (SWP). It is the reverse of a systematic investment plan. The investor can choose to redeem units worth a predetermined sum each month to meet his regular cash flow needs.

If one lets his money grow in an equity fund or an aggressive hybrid (erstwhile balanced funds) for one year and then registers for SWP, then all the gains on the units sold are subject to 10 per cent tax. More importantly, long-term gains up to ~1 lakh per year are exempt from long-term capital gains tax.

You can also set up SWP on a bond fund. “Investors should keep in mind the safety of their capital, predictability and frequency of returns and tax treatment of returns while choosing instruments for deriving regular income. The best way to derive regular income through mutual funds is to invest lumpsum in short-term debt funds and arbitrage funds and activate Systematic Withdrawal Plan (SWP) in ultra-short duration debt funds and dividend option in arbitrage funds. Invoking SWP allows redemption of a pre-determined amount from your mutual fund(s) to your bank account at regular intervals,” says Naveen Kukreja, CEO and co-founder, Paisabazaar.com.

Kukreja points out that both ultra-short duration funds and arbitrage funds ensure a high degree of capital protection. As far as arbitrage funds are concerned, opting for the dividend option is more tax-efficient than the SWP mode.

Gains earned on investments held for more than three years in bond funds are taxed as long-term capital gains at the rate of 20 per cent with indexation. That curtails the tax impact on withdrawals made after three years. Before completing three years, if you opt for SWP then your gains are taxed at the marginal income tax rate.

Kukreja also advises investors to keep in mind the exit load of schemes while considering SWP. “Make sure to check the exit loads of funds as some charge loads of up to 1 per cent on redeeming before a pre-specified period. Opt for direct plans as their lower expense ratio will translate into higher returns than regular plans,” he says.

)

)