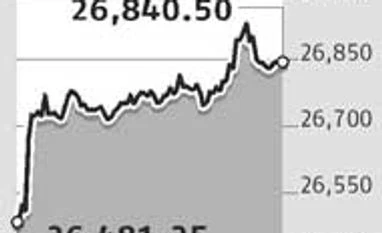

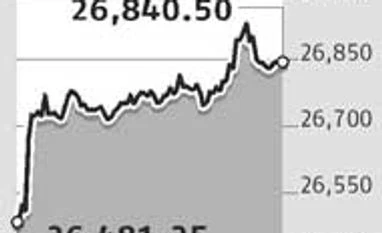

Sensex snaps 6-session losing streak, up 359 pts

Press Trust of India Mumbai The benchmark BSE Sensex snapped a six-day losing streak by surging 359 points on Wednesday and rebounded from near an eight-month low to 26,840.50 on value-buying in blue-chips Bharat Heavy Electricals, Bajaj Auto and Reliance Industries.

Besides, the rupee’s recovery against the dollar to Rs 63.83 boosted sentiment.

Foreign funds and retail investors started buying after MSCI decided not to add Chinese stocks to its widely tracked emerging-markets index. The inclusion would have resulted in a sharp increase of China’s weight-age in the index, which would have come at an expense of other emerging markets, including India.

“Deferral of China’s shares into MSCI index, strong global cues and stronger rupee lifted the sentiment,” said Gaurav Jain, Director at Hem Securities.

Recovery was so strong that all 12 sectoral indices closed with gains between 0.3 and two per cent. Information technology, capital goods, automobile, oil & gas, banking and power sectors led the pack.

The Sensex opened on a strong footing at 26,517.32 and continued its upward trend to hit the day’s high of 26,934.74 on across-the-board value buying in blue-chips. However, due to profit-booking at higher levels, the index slipped at the fag-end and closed 359.25 points, or 1.4 per cent higher, at 26,840.50.

The 50-share National Stock Exchange’s Nifty halted its seven-session falling trend and reclaimed the 8,100-mark by surging 102.05 points or 1.3 per cent to close at 8,124.45.

“A relief rally after seven consecutive selling trading sessions was witnessed at the bourses on the back of short covering and lower-level buying,” Jain said.

Stocks of BHEL emerged top gainers among 30-Sensex stocks by surging 4.21 per cent to Rs 251.40, followed by Wipro 3.60 per cent to Rs 563.30.

Among other Asian markets, China, Singapore and Taiwan ended higher, while Hong Kong, Japan and South Korea finished lower.

)

)