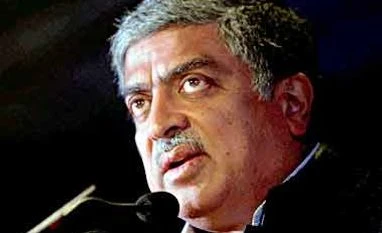

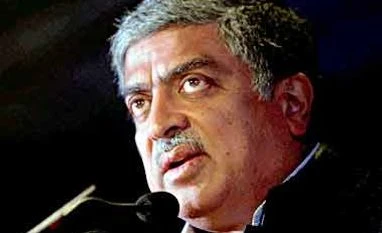

'Whatsapp' like movement in Indian finance sector: Nandan Nilekani

Says the India's move towards less cash has already started, to become a more digital cash society

Press Trust of India Bengaluru IT czar and former UIDAI Chief Nandan Nilekani today said India is witnessing a "Whatsapp" like movement in the finance sector due to emergence of payments banks, e-sign, IMPS and other technology-related revolutions.

"...In 2009 there was a Whatsapp movement in telecom. My analysis is, in 2015 there is a Whatsapp movement for finance in India.

"Change is coming on many fronts new licences, smart phone Aadhar identification, e-sign, payment banks etc. Some of it is regulated, some of it is technology, some of it is design, and some of it is market," Nilekani said.

He expressed the views while delivering a keynote address on "Disruption in Financial Services" at TiE LeapFrog 2015 here.

He also complemented the RBI on granting licenses to payments banks, calling it "a great revolution".

"Payments bank is a great piece of innovation from RBI; and now we have eleven, no one expected eleven..... This will create another huge revolution," Nilekani said.

He said initiatives like Jandhan and Aadhar, Immediate Payment Service (IMPS), Unified Payments Interface (UPI) , licences to payments banks and digitisation of Indian economy have contributed to "Whatsapp movement" to Indian economy. Taking smartphone to half a billion people was also a revolutionary movement in this regard.

The Reserve Bank on Wednesday granted 'in-principle' approval to 11 entities, including Reliance Industries, Aditya Birla Nuvo, Vodafone and Airtel, to set up payments banks and proposed such licences 'on tap' in future.

Stating that India is moving fast towards electronic payments, Nilekani said "the move towards less cash has already started, to become a more digital cash society."

Steps such as electronic clearance of cheque, IMPS, mobile wallets, Direct Cash Transfer (DCT) and payments banks are helping in realising this, he added.

Calling Aadhar a "game changer", he said it has already crossed 900 million people and will touch one billion mark by March 2016.

)

)