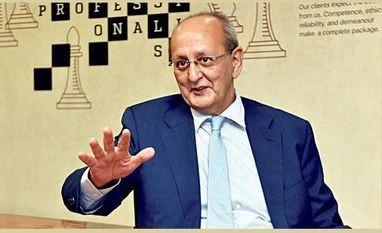

Is too much money chasing too few stocks in Indian markets? Which themes and sectors will do well in Samvat 2078? Avendus Capital CEO Andrew Holland answers these questions in this exclusive interview

)

Listen to This Article

Is too much money chasing too few stocks in Indian markets? Which themes and sectors will do well in the markets in Samvat 2078? How will the global equity markets play out? What are the risks to the rally, and are all those risks priced in? Avendus Capital CEO Andrew Holland answers these and more questions in this exclusive interview with Business Standard’s Puneet Wadhwa. Highlights of the Q&A:

Q. How do you see global equity markets playing out in the next one year? What are the risks to the rally, and are the markets pricing in all those risks right now?

Answer

- Markets are ignoring many headwinds

- Liquidity is still king!

- There is a market correction coming

- Key question is how to get growth going

Q. What are your return expectations from the Sensex and Nifty over the next one year?

Answer

- India has a number of tailwainds behind it

- Retail investors are a now a force to reckon with

- Overall earnings growth will be strong despite high commodity prices

- New-age companies will keep the market interest alive, especially of foreign investors

Q. But most retail investors have not yet seen the market crash akin to 2000, or the global financial crisis. Isn't that a risk?

Also Read

Answer

- Retail flows were strong even in the 2020 market crash

- A crash now will test medium-term investors

- Sharp rally in select mid and smallcaps without accompanying fundamentals a worry

Q. Is there too much money chasing too few stocks in Indian markets?

Answer

- Large-caps have seen some concentration and rotation

- Insurance, asset management themes still look good

- Though the index may not move up much, select themes will do well

- Insurance, asset managers likely to do well

- Hospitality sector also looks good

Q. Given that prices of key commodities are on an upswing, are we looking at a couple of quarters of earnings downgrades instead of earnings momentum picking up?

Answer

- Earnings projections can be downgraded globally, including in India

- India Inc'c commentary/guidance in the September quarter eyed

- All this can trigger a correction in global equities

- Good news for the economy: Govt spending in India yet to kick in

- High price-to-earnings ratio the new norm

Q. How are the FIIs viewing India as an investment destination?

Answer

- FIIs like the India story

- FDI in new industry segments key

- India's GDP growth still in early stages. More headroom available

Q. So what's your advice to retail investors – temper return expectation in the new Samvat or go all in as we still are in the middle of a big bull market?

Answer

- Do not look at returns from the frontline indices

- Look for companies that can deliver superior growth and then invest

More From This Section

First Published: Oct 25 2021 | 11:22 AM IST