Stocks of Aditya Birla Fashion and Retail (ABFRL) have not been a favourite on the bourses but brokerages remain bullish, hoping the network expansion of Pantaloons will bring growth.

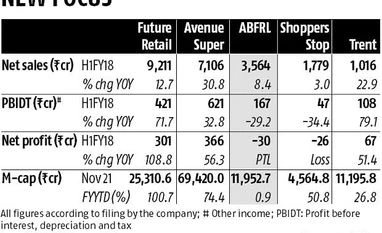

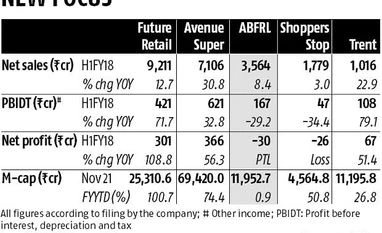

Stocks of most retailers have surged in the current financial year. Future Retail and Avenue Supermart (D-Mart) rose 100 per cent and 74 per cent, respectively. But ABFRL has moved less than one per cent.

Despite this slow movement, CLSA has maintained a ‘buy’ on the stock in a note sent to its clients early this week. The brokerage, like some of its peers, said it was betting the expansion of retail chain Pantaloons would drive growth for the company.

S Visvanathan, chief financial officer of the company, said in a recent investor call, “Driving growth through expansion in existing businesses and investing in chosen white spaces with focus on profitability improvement will continue to be our strategy.”

Pantaloons remains key to this expansion strategy at a time when brand business under Madura has achieved significant scale. Madura is a market leader in men's fashion with brands such as Louis Philippe, Van Heusen, Allen Solly and Peter England.

Compiled by BS Research Bureau; Source Capitaline

At least three of these brands have recorded Rs 1,000 crore in annual sales. It also had 1,893 exclusive brand outlets at the end of September.

In the first six months of the current financial year, Pantaloons recorded Rs 1,471-crore revenue, lower than Rs 2,169 crore provided by Madura Fashion & Lifestyle.

The company has added 36 Pantaloons stores in the first half of the financial year, taking the total to 243. It now plans to add a similar number of stores in the second half, according to a report by Edelweiss Securities. Pantaloons is also undergoing a turnaround in operations.

“We expect the company to record decent SSSG (same-store sales growth) led by new business model with a focus on right pricing and fashion,” said Abneesh Roy, analyst with Edelweiss Securities. “The company’s initiatives, like increasing private labels, enhancing inventory turns and reducing sale season period, are bound to lead to sustained margin improvement.”

The company had recorded a loss of Rs 30 crore in the first half of the financial year.

While Pantaloons’ revival is pinned on expansion, Madura’s business is expected to see a gradual upswing. “The management intends to shore up growth in Madura by creating brand extensions like innerwear, athleisure and introducing new international brands like Collective, Ted Baker and American Eagle,” said Bharat Chhoda, analyst with ICICI Securities. “Despite near-term numbness, we believe these efforts would provide cohesive growth and position Madura on a strong footing in FY19 and FY20.”

)

)