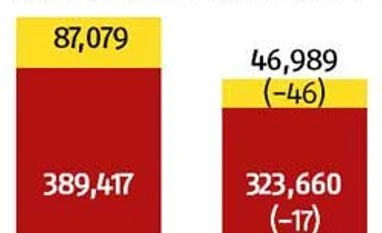

Pune-based Bajaj Auto, the country’s biggest exporter of two- and three-wheelers, saw a steep decline in exports in the June quarter.

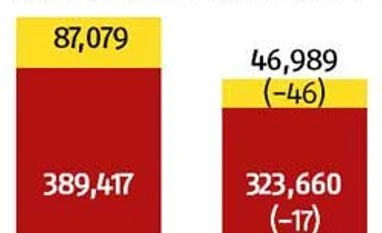

The third largest maker of two-wheelers reported a fall of 22 per cent, with a demand slide in Nigeria and Egypt, two of its biggest export markets. Export revenue for the quarter fell to Rs 2,057 crore, from Rs 2,634 crore a year before. Exports generate 45 per cent of the Bajaj Auto’s business. The company is, however, confident of achieving its target for the year. It expects both Nigeria and Egypt to return on track and points to addition of new markets in the current quarter. Kevin D’Sa, president (finance), said: “Our guidance (forecast) for the year was 4.6 million vehicles. The second was 1.6 million for vehicle export. I believe we should be able to cross the targeted rate of 133,000 exports a month.”

The Nigerian market has weakened due to economic turmoil there, that had led to a devaluation of its currency and its unavailability of dollars. This led Bajaj to cut prices, to stay competitive. The African nation used to contribute 40,000-45,000 units a month, now down to 20,000 units. About 20 per cent of three-wheeler and three per cent of motorcycles in total exports go to Egypt. That country saw devaluation earlier this year, impacting Bajaj Auto. “I don’t see myself going below the 133,000 numbers per month mark; I expect it to go higher. Hopefully, in the third or fourth quarter, things should improve. The vision for the next two months is at the same 132,000-135,000 run rate,” added D’Sa to analysts on an earnings call.

At home, Bajaj Auto is running slightly behind its target of 220,000 a month. In the June quarter, the monthly average was 183,000 units. This is despite new launches such as the V15 and Avenger series. The company is targeting sales of 2.6 million motorcycles this financial year in the domestic market. However, favourable monsoon is expected to give rural markets a boost, new product launches, implementation of the Seventh Pay Commission and higher military pensions, two-wheeler consumption is expected to rise in the coming months.

“I believe the second half will outperform, given the fact that the monsoon has set in and is pretty okay, beside a hike in the salaries of government employees. In value terms, the industry will grow significantly higher, as people will upgrade with the extra income,” said D’Sa.

On products, the company has readied new launches in the Pulsar category, including refreshed variants, after the festive season and the launch of the Pulsar 400 in August. The latter is being targeted at buyers looking for a Rs 1.5-2 lakh motorcycle, said D’Sa. Further, some more derivatives of the V15 will be seen, including one with a more powerful engine.

Capital expenditure this year will be Rs 300 crore, which could be on increasing the capacity for three-wheelers. The June quarter saw a 48 per cent jump in production volumes of three-wheelers, led by new launches.

)

)