Bajaj Electricals: Weakness in consumer durables may continue

Rationalisation of inventory at dealer level and stiff competition to weigh on business in this segment

Sheetal Agarwal Mumbai Bajaj Electricals’ consumer durables business is seeing continued pressure from slowing consumption, market share loss to competitors and implementation of its own 'theory of constraints' (ToC) strategy, under which it is reducing inventory levels with dealers.

As a result, the segment, 40 per cent of revenue and a fourth of the operating profit, has become highly volatile, registering low single digit (two to three per cent) year-on-year growth in two of the past five quarters ending this September's. For the remaining three quarters in this period, the segment’s revenue fell by two to six per cent.

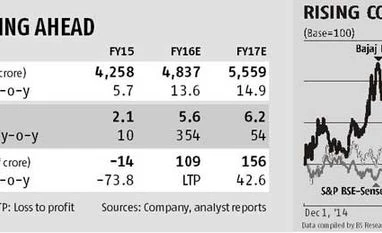

The management has cut its earlier expectation on revenue, as well as earnings before interest and taxes (Ebit) margin, for this segment for FY16, by 4.5 per cent and 200 basis points, respectively. It now expects this segment to post revenue of Rs 2,100 crore and an Ebit margin of six per cent. Thus, the near-term prospects of this segment appear dim, with the benefits of ToC fructifying only in the longer run.

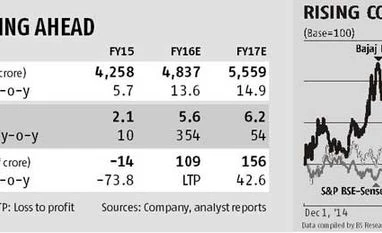

Despite these pressures, Bajaj Electricals’ consumer durables business is trading at premium valuations to peer Havells India's standalone/ domestic business. “Bajaj’s consumer business is trading at 31 times the FY17 estimated earnings per share, at a 12 per cent unjustified premium to Havells’ standalone business,” believe Bhargav Buddhadev and Deepesh Agarwal of Ambit Capital. They add Bajaj will continue to lose market share to rivals as it expands its ToC rollout. The latter has been implemented in 20-30 per cent of its distribution network and the company intends to take this up to 70 per cent this financial year. Any demand uptick in this festive season, though, could partly aid the December quarter results.

Its lighting business (23 per cent of revenue, 36 per cent of Ebit), on the other hand, has seen some improvement in revenue growth over the past two quarters. Even excluding the low base effect in these, the revenue growth appears decent. The company will execute orders worth Rs 120 crore to supply LED lamps to Energy Efficiency Services (a public sector joint venture to facilitate energy efficiency projects) this financial year. The management has raised this segment’s full-year revenue forecast by 10 per cent to Rs 1,100 crore. It has also led to improvement in the segment’s Ebit margin.

With an order book of Rs 3,200 crore, the engineering and project (E&P) business (37 per cent of revenue, 38 per cent of Ebit) is expected to grow at a healthy 24 per cent in FY16. “Albeit, taken longer than expected earlier, we expect the E&P business to post a strong turnaround in FY16,” believe analysts at Motilal Oswal Securities.

Overall, there's a healthy outlook for the lighting and E&P business but consumer durables will continue to face pressure on revenue and profitability. The scrip trades at 14 times the FY17 estimated earnings, slightly higher than its historical average one-year forward price to earnings ratio of about 13. Investors should, thus, await signs of stabilisation in this business.

)

)