Bengaluru surpasses Mumbai in attracting angel investment

Report says in FY15, Bengaluru-based start-ups received 29% of the overall angel investment, followed by 24% for Mumbai and 18% in the case of Chennai

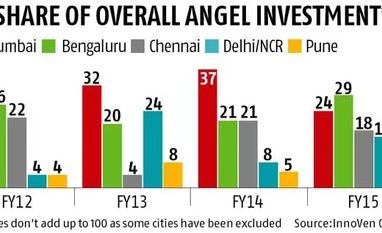

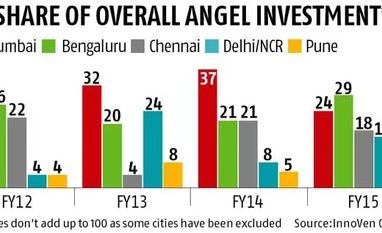

Bibhu Ranjan Mishra Bengaluru In terms of attracting investors in early stages, Bengaluru-based start-ups have largely lagged those in Mumbai, India's commercial capital. In 2014-15, however, Bengaluru pipped Mumbai in attracting angel investment in start-ups, according to a report by InnoVen Capital, a venture debt provider and subsidiary of Singapore-based investment company Temasek Holdings.

The report said in FY15, Bengaluru-based start-ups received 29 per cent of the overall angel investment, followed by 24 per cent for Mumbai and 18 per cent in the case of Chennai.

The report is based on data collated from five large angel groups - Mumbai Angels, Indian Angel Network, The Chennai Angels, Calcutta Angels and Hyderabad Angels - between April 2011 and March this year. These angel groups, represented by about 700 angel investors, are part of the Association of Indian Angel Groups.

Angel groups' increased investment in start-ups located here could be testimony to the fact that Bengaluru accounts for a vast majority of start-ups in the online services space, a favourite of investors in FY15.

"Perhaps, if you look at the investment distribution by sectors, companies in e-commerce and online services are taking a larger share of the investments and these companies are mostly located in Bengaluru. This could partly be due to the high real estate costs in Mumbai," said Ajay Hattangdi, chief executive officer and managing director of InnoVen Capital India.

The report also said 76 per cent of the start-ups that received funding from angel investors in FY15 were those that generated revenue, as opposed to 40 per cent in FY12.

This number has been steadily rising since FY13, indicating companies with mere ideas captured in power-point presentations aren't what angels are looking at.

"This means angels are now beginning to fund companies much later in their lifecycles, once they have an established business model and are generating revenues. So, it is part of the evolution of the market in some ways," said Hattangdi.

Angel investors are also seen to be making greater follow-on investments on existing ones. In FY15, more than a quarter of all investments were in follow-on rounds, against 16 per cent in FY14, six per cent in FY13 and seven per cent in FY12.

"This reflects angels are supporting their (portfolio) companies for much longer than they used to earlier," said Hattangdi.

In terms of sectors, information technology (IT) and IT-enabled services (ITeS), which took off late in terms of investments, seem to have attracted a lot of interest. In FY15, start-ups in the IT/ITeS space were the highest recipients of funding from angel groups at 21 per cent, followed by online services (18 per cent) and consumer and services (17 per cent).

In FY14, IT/ITeS start-ups received only two per cent of the overall investment, against 13 per cent in the previous financial year. This shows these companies are expected to play a bigger role in creating the technology backbone of segments such as e-commerce, online services and consumer services and health care, say experts.

According to the InnoVen Capital's India Angel Report, in the past four financial years, 153 deals were reported by angels groups, with an overall financial commitment of Rs 204.27 crore.

)

)