Cement sector eyes growth in FY16

Renewed govt spending, real estate likely to boost growth by 7.5%, claim experts

Sohini Das Ahmedabad The cement sector is hoping for a revival this financial year.

After a gap of four years, the industry is optimistic on demand and capacity utilisation increasing.

The first half of FY15 nurtured hopes of better growth but the second half was shot by a slowdown, especially in the quarter ending in March because of the government cutting expenditure.

Despite the slowdown, sector insiders and analysts are hopeful of increase in production — by at least seven to 7.5 per cent — in the current financial year.

Credit rating firm Icra said all-India cement production increased only 1.8 per cent in the period between October, 2014 and March, 2015. In the April-September, 2014 period it grew by 9.7 per cent.

“The pre-election spending and a delayed monsoon had led to a spurt in growth of demand for cement in the first half of FY15 but it slowed down after the elections got over.”

In the final quarter of FY15, government spending was cut, demand from the real estate and construction sectors was mute and income from agriculture decreased because kharif production saw a decline in due to poor monsoon. All of this affected demand for cement. The trend, however, is expected to reverse.

Centre for Monitoring Indian Economy Private Limited said: “This trend in cement demand is likely to reverse during FY16 on account of higher government spending on infrastructure as announced in the Union Budget. This is likely to boost the demand for cement from real estate and infrastructure sectors. Therefore, we expect the growth in cement output to accelerate to nine per cent during the year. A total of 289.4 million tonnes of cement is likely to be manufactured during the year.”

In the following year, the output is likely to grow by 8.1 per cent backed by a sustained healthy growth in demand.

Cement players and a few analysts are, however, sceptical.

“The growth of infrastructure is directly related to the GDP (gross domestic product) growth. The realistic prediction for GDP growth is in the range of six to 6.5 per cent for the current fiscal. And going by that estimate, cement demand would rise by seven to 7.5 per cent, or touch eight per cent at the most,” said Yashwant Mishra, president (corporate), Mangalam Cement.

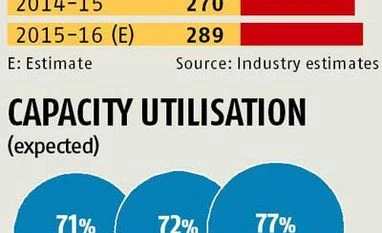

Ravi Sodah, an analyst with Elara Capital, too, feels the same. “Around seven per cent consumption growth is expected this fiscal. The production in FY15 was around 270 million tonnes (mt),” he said.

Sodah also said while there is no official data on consumption, it is usually in tandem with production growth as production is monitored in accordance with demand. According to Icra, all-India cement production grew by 5.6 per cent in FY15 as compared to three per cent in FY14.

According to Centre for Monitoring Indian Economy (CMIE) analysis, the real estate sector alone is likely to see project completions worth Rs 20-lakh crore during 2015-17. It also expects activity to pick-up in the roads and highways construction space during the same period. “About 8,314 km of roads are expected to be built during 2015-16. In the subsequent year, infrastructure companies are expected to construct 8,624 kms of road. This is much more than 3,400-4,500 km of road network added in each of the preceding five years,” it stated.

While the above factors are likely to boost cement consumption, Icra highlights the industry has seen a slowdown in addition of new capacities due to supply glut faced in recent times.

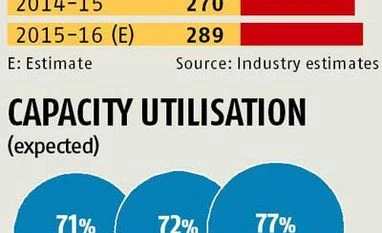

For instance, between FY11-FY15, the industry added 92 mt per annum (mtpa) cement capacities as against 122 mtpa in the preceding four-year period FY07-FY11. However, slowdown in demand (cement production grew six per cent during FY11-FY15 as against 7.6 per cent during FY07-FY11) resulted in decline in capacity utilisation from 77 per cent in FY12 to 72 per cent in FY14 despite slowdown in fresh capacity addition.

Icra expects the industry to add 28 mtpa capacities during FY16-FY17; 21 mtpa in FY16 and eight mtpa in FY17 as against the peak addition of 50 mtpa in FY10. “Assuming a demand growth of eight per cent over the next two years, the all-India cement capacity utilisation is likely to improve from 71 per cent in FY15 to 72 per cent in FY16 to 77 per cent in FY17. Delays in project execution and project commissioning may result in higher capacity utilisation levels,” Icra forecast.

)

)