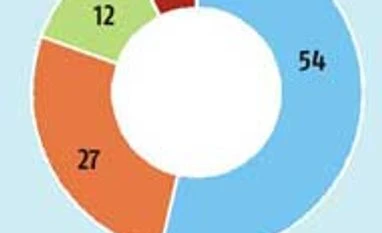

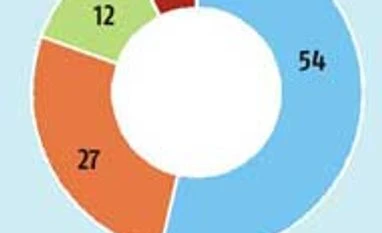

Private equity firms made 41 exits during the first quarter of 2015 (calendar year), up 58 per cent from 26 exits in the year-ago period, Venture Intelligence data showed. Twenty were complete exits, while the rest involved sale of partial holdings.

Sale of shares in already listed companies (via the public markets) accounted for 22 exits and provided a median return of 2.34x (versus 1x in the first quarter of 2014). Four of these represented complete exits, including ChrysCapital's sell-off of holdings in ING Vysya Bank for Rs 838 crore, to book a 3.6x return on its investment.

Anand Narayan, senior managing director of Creador Advisors India, said given the extended period of poor exits since 2010, many funds were finding it tough to demonstrate the track record for their next fund raise. The uptick in the stock markets after the general election opened a window of opportunity for many of the listed investments in cyclical sectors such as infrastructure, automobile components, engineering, etc. The buoyant economic mood also resulted in secondary transactions in long-term growth sectors such as health care, financials, etc, which probably contributed to some of the funds demonstrating a track record before going back to raise their next rounds.

Two exits for Creador in Repco and Old Town generated internal rate of return in excess of 70 per cent for its investors. "Given the current high valuations globally, all investors might have to think through how they are going to deliver returns for their LPs (limited partners). Creador continues to find attractive opportunities across a wide spectrum of businesses in its target geographies," said Narayan.

Among part-exits, Tiger Global pared its stake in JustDial by selling 3.4 per cent stake for Rs 300 crore, a return of 14x. Sequoia Capital India sold off a five per cent stake in eClerx for Rs 192.4 crore, a 4.86x return. Lighthouse sold partial stakes in two of its portfolio companies, Dhanuka Agritech and Shaily Engineering Plastics, registering returns of 6.3x and 4.5x, respectively.

However, exits via initial public offering were a dampener during the first quarter of 2015 (calendar year), with New Silk Route having to cut the number of shares it had planned to sell in Ortel Communications to rescue the issue from failing.

Among exits via strategic sales, Japan-based Igarashi Electrical Works, along with Bengaluru-based boutique investment bank MAPE Advisory Group, acquired a 97.9 per cent stake in auto components Agile Electric Sub Assembly Pvt Ltd from Blackstone for $106 million.

The deal helped Blackstone register a 2x return on its July 2013 investment of Rs 332 crore. The acquisition of daycare surgery firm Nova Medical by Apollo Hospitals provided an exit for NEA, Goldman Sachs and GTI Group.

Twitter's acquisition of ZipDial for a reported $30 million (around Rs 180 crore) paved way for the exit of its venture capital investors including Jungle Ventures, Unilazer Ventures and Blume Ventures. ZipDial had raised a total of Rs 19 crore from its VC investors.

Secondary sales accounted for five of the exits including Carlyle's buyout of the majority stake held by New Silk Route in financial services firm Destimoney, Kedaara Capital's purchase of ChrysCapital's stake in unlisted cartons and paper packaging company Parksons Packaging.

Also, IDG Ventures India and DFJ ePlanet Ventures completely exited retail data analytics firm Manthan Systems with 7.7x and 4.36x, respectively, as part of the Rs 370-crore investment by Temasek Holdings, while Fidelity Growth Partners made a partial exit with a 4x return. Similarly, Access PE sold a part of its holdings in diapers maker Nobel Hygiene to incoming investor CLSA Capital (realising a 2x return), while microfinance lender Ujjivan witnessed investors such as Sequoia Capital, FMO Wolfensohn and Lok Capital selling their stakes to new investors.

The first quarter of 2015 (calendar year) also witnessed three exits via buybacks including publicly-listed PVR Ltd's purchase of entire stake held by L Capital in its subsidiary PVR Leisure Limited. (In August 2012, L Capital had acquired a 44 per cent stake in PVR Leisure for Rs 51.1 crore ).

IIML and Franklin Templeton PE sold their shares in SFO Technologies to a promoter entity. In May 2011, the PE investors had invested Rs 166.5 crore for a 25.17 stake. ICICI Venture divested its entire equity stake in Chennai-based facilities management firm Updater Services to a special purpose vehicle owned by the promoters of Updater. In February 2008, ICICI Venture had invested Rs 40.8 crore or $9 million in Updater.

)

)