Lower provisions, cost control aid HDFC Bank earnings

Lower provisions, cost control aid earnings growth

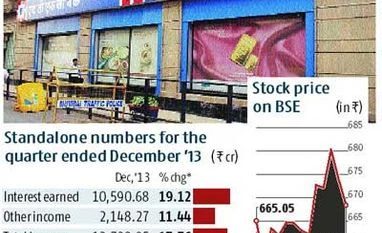

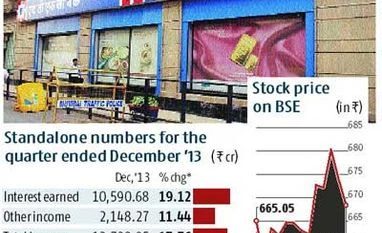

BS Reporter Kolkata HDFC Bank, the second-largest private sector lender in India, on Friday said its net profit for the quarter ended December 31, 2013, increased 25.1 per cent from a year earlier to Rs 2,325.7 crore, as it cut provisions and kept a tight leash on operating expenses. The consensus Bloomberg net profit estimate for the bank was Rs 2,309 crore. The stock ended the day down 0.84 per cent at Rs 668.30.

This is the second consecutive quarter when the year-on-year growth in the private lender’s three-month profit is below 30 per cent. The bank’s quarterly profit after tax was growing at over 30 per cent for nearly a decade till the first quarter of this financial year.

“We never had a number that we wanted to stick to. Our aim has always been to grow a little faster than the system and we will continue to do so. This quarter, our profit growth was clearly boosted by tight cost control. Our asset quality also improved and that gave us some cushion in terms of lower provisioning,” said Paresh Sukthankar, deputy managing director of HDFC Bank, in his post-earnings comments.

Net interest income, or the difference between interest income and interest expenditure, grew 16.4 per cent from a year ago to Rs 4,634.8 crore during the three-month period. Net interest margin fell by 10 basis points from a year earlier to 4.2 per cent during the quarter. Other income was up 11.4 per cent on a year-on-year basis.

Operating expenses rose only 3.8 per cent, aided by lower staff cost as the bank’s headcount fell by 1,500 employees in the past 12 months. This allowed HDFC Bank to improve its cost-to-income ratio to 43 per cent at the end of December 2013 from 47 per cent a year earlier.

Asset quality remained stable and helped the bank to pare provisions to Rs 388.8 crore in the third quarter from Rs 405 crore a year earlier. Gross non-performing asset ratio was one per cent, while net bad loan ratio was 0.3 per cent. Total restructured loans (including applications under process for restructuring) were 0.2 per cent of gross advances.

“We are satisfied with our asset quality performance. The rate of formation of non-performing loans has come down during the quarter,” said Sukthankar.

Advances increased 22.9 per cent from a year earlier to Rs 296,742 crore at the end of December 2013. The growth in advances was aided by domestic corporate loans, which rose 22.1 per cent from a year ago. Working capital loans was the main driver for wholesale credit growth. Retail loan growth, on a year-on-year basis, was 13.6 per cent. Total deposits of the bank also grew 22.9 per cent from a year earlier to Rs 349,215 crore.

HDFC Bank closed the quarter with a capital adequacy ratio of 14.7 per cent, according to Basel-III rules.

“In light of the current macro environment, the current earnings trajectory of 25 per cent-plus growth is impressive and much better than other large private peers, which in our view, justifies a premium valuation multiple. Hence, we recommend accumulate rating on the stock,” said Vaibhav Agrawal, vice-president – research (banking), Angel Broking.

)

)