What is a financially safe company? Is it one that is nearly debt-free and earns over 20 per cent returns on capital employed (RoCE) in its business; or one with a debt-to-equity ratio of around one and RoCE of around 10 per cent? Or is it a company with the leverage ratio of more than three and RoCE in a low single digit? If rating agencies in India are to be believed, all three are equally safe with little or no chance of default on their debt.

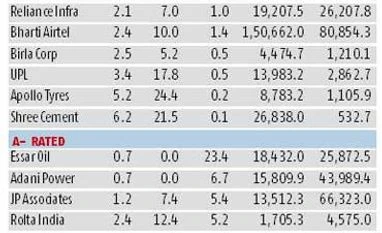

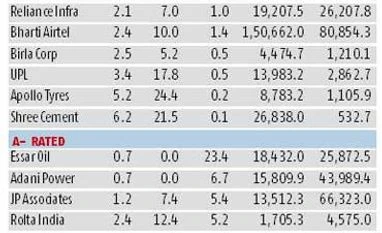

Shree Cement, Indian Hotels, Cox & Kings, Century Textile and Reliance Infrastructure are all rated ‘AA’ for their domestic debt issues, despite contrasting financial ratios.

Shree Cement is nearly debt-free, has a RoCE of over 20 per cent and enough operating profit to cover six years of interest payment. By comparison, Indian Hotels has a net debt-to-equity ratio of 2.1 times, reported losses last financial year and its operating profit was just 1.9 times its interest expenses. Cement, textile and paper maker Century Textile’s leverage ratio was 3.6 times in 2013-14, it earned just 5.1 per cent on its capital and its operating profit was just enough to cover a year of interest payment. Ditto for travel and tour operator Cox & Kings, which was struggling with a leverage ratio of three times at the end of March this year. The financial ratios of Anil Ambani group’s Reliance Infrastructure are somewhere in the middle, but the company still enjoys similar ratings.

A Business Standard analysis of 248 of the BSE-500 firms based on the latest long-term credit ratings (excluding banking & financial firms), shows nearly 90 per cent of the firms (232) are investment grade with credit rating of BBB and higher, while 38 (15 per cent of the sample) are AAA rated. The companies that did not get themselves rated as they did not plan to borrow were also excluded from the sample.

Analysts say the widening gap between a company’s financial ratio and its credit rating raises questions over the accuracy of credit ratings in the country. “Credit ratings often give false sense of comfort to lenders,” says an analyst who does not wish to be named.

The case with Bhushan Steel was similar. The firm, despite being one the most indebted in its sector and its market capitalisation being a fraction of its total debt, was rated A- (adequate safety and low risk of default) until a few weeks ago. For over a year now, Bhushan Steel’s stock price has been falling despite a rally in steel stocks which indicates market scepticism about the firm’s finances. However, rating agencies took action only last week and downgraded it by four notches in one swoop to BBB-, a sub-investment grade category.

Critics blame this on competition among rating agencies. “Many companies virtually do rating shopping in India,” says a senior official with a domestic rating agency, asking not to be named.

But rating agencies refute this. They say they follow a transparent rating matrix and there is a Chinese wall between the analytical team, which assigns ratings, and the business development team. “Financial ratios are only one of the many metrics used to rate a company. We also take into account factors like management quality, the company’s track record, its industry position, degree of support from the parent or promoter group and the project analysis,” says Arun Kumar, head of rating at CARE Ratings.

This means two companies with contrasting balance sheets could end up getting similar ratings, as one could score higher on other factors. “A company with higher market share or belonging to a large and reputed business group could be rated higher, despite its poor financial ratios,” says Kumar.

Agencies also say ratings only reflect a probability of default, nothing more. “If business environment changes swiftly, even an AAA-rated company might default on its debt. The only difference is that a company with a higher rating has a lower probability of default than one lower on the scale,” adds Kumar.

“While financial ratios are important, we also look at the implicit and explicit comfort that a company gets from being part of a business group. And, if the parent or the promoter company has strong finances, it has a positive impact on the ratings of subsidiaries and associates,” says Karthik Srinivasan, head financial ratings at ICRA Rating.

AAA-rated securities are considered the safest and the margin of safety declines progressively as the number of As declines or Bs come in. While sub-investment grade rating starts at BB, those rated C and D have either defaulted or are close to defaulting.

)

)